This article is part of a series of analyses devoted to the medium and long-term impact of COVID 19 on different sectors of activity. The report below on the non-food retail industry is in line with another paper we have published on food retail in the post-COVID19 era. We updated this article in October 2020 with the latest statistics on the impact of COVID on the retail sector in 2020.

To receive our most recent reviews, subscribe to our newsletter (below). The information we publish (including the names of the companies we bet on in the future) is reserved for our subscribers only.

This study is part of a series of analysis on the impact of Covid-19 on :

Summary

- Introduction

- Impact 1: lower demand

- Impact 2: crisis in the clothing sector and foreseeable adjustments

- Impact 3: some areas will be less affected

- Impact 4: health security = strategic challenge

- Impact 5: Shopping mall abandonment and foreseeable adaptations

- Impact 6: layout of physical stores and online offers

- Impact 7: virtual reality boom

- Impact 8: new dimensions of the customer experience

- Conclusion

The essence of Covid impact on non-food retail

- The health safety of customers at the sales outlet is becoming a strategic issue. It will be the only investment item in 2020. Investments will be frozen in all other areas.

- The online channel is anchored in purchasing habits and will lead to an unprecedented wave of digitalisation projects. Within 3 years, all retailers will have to have e-commerce at the risk of perishing. This will be the central investment of the year 2021.

- Retailers in the housing development sector will be less affected by the crisis. A period of growth could even begin to emerge from 2021-2022.

- The drop in demand will impact purchases of durable goods, causing a significant catch-up effect for electronic products. A wave of bankruptcies will follow, which will consolidate the market around a few notable players.

- Physical points of sale will see their profitability fall. Smaller sales areas will be favoured. Retailers will have to juggle 2 adjustment variables: depth of inventory on the one hand, and sufficient space to ensure social distancing on the other.

- Non-food retailers will multiply immersive experiences to keep customers out of the store.

- The customer experience will become a significant strategic asset, but only by 2021-2022. Customer loyalty will be on the list of all retailers. Some dimensions of the customer experience will be more critical than others to win.

Introduction

The medium- and long-term consequences of COVID-19 on the non-food retail sector differ substantially from those on the food retail sector. The first significant difference is that the former had to go into an artificial coma for several weeks; the latter was allowed to continue its activities. In doing so, a clear distinction was made between essential purchases and those that were “superfluous”. We could talk about specific examples (florists, car dealers), but we think it would be wiser to identify global trends, applicable to all non-food retailers.

The latest statistics on the impact of COVID on the retail sector in France

The latest figures on the effects of COVID on the retail sector in France are a good baseline for assessing the more global impacts.

First lesson: only the food retail sector has thrived. Annual turnover is up 3% to 5.973 billion Euros.

All the other components of the retail sector recorded a decrease in turnover:

- Health and beauty: -13%

- Culture and leisure: -16%

- Household equipment: -17%

- Automotive: -20%

- Personal equipment: -25%

- Catering: -35%

- Services: -38%

- Accommodation : -46%

- Leisure and entertainment: -47

In the end, the retail sector in France will decline by 15% in 2020, which represents a loss of nearly 93.5 billion Euros.

IMPACT 1 : baisse de la demande

For durable consumer goods, a drastic reduction in consumption can be expected. For the automobile sector, I interviewed Jose Fernandez, the CMO of D’Ieteren (importer of the brands of the VW group in Belgium), who predicts that the sales level of 2019 will not be reached again. He also anticipates a renewed interest in the use of the private car to the detriment of public transport. The personal vehicle will be considered as a protective cocoon, and one can, therefore, legitimately question the demand for shared mobility services in this context.

A sustained fall in demand in the automobile sector

Registrations in March 2020 fell by 55.1% compared to March 2019 (ACEA figures). This is not surprising. The figures by country are very contrasted: from -85.4% in Italy (which went into confinement first) to -37.7% in Germany (whose health situation is one of the best in Europe). Let’s take a quick look at the other countries: -72.2% in France, -69.3% in Spain, -44.4% in the United Kingdom.

The figures are, therefore – logically – much more catastrophic than those of 2008. Ten years after the crisis in 2008, sales had still not reached the level of 2007. One can therefore legitimately wonder whether car sales will ever reach their 2019 level again. That is unlikely. Significant recovery is only possible if governments offer tax incentives to renew the car fleet. Remember that in 2019 the average age of a vehicle in the European Union was 10.8 years according to ACEA, with significant disparities between eastern and western countries. While the average was only 8 years in Austria, it was 16.7 years in Estonia.

In Italy, the average passenger car was 11.3 years old in 2019. A study by Autoscout24 reveals that only 3% of Italians would have changed their car purchase plans since the “lockdown“. A glimmer of hope remains, even if of course this is only a poll and declarative opinions. If the lockdown and bans continue, a new car will become relatively useless, and these small hopes would disappear.

Electronics is another important vertical of non-food retail Here, a catch-up effect can be expected. The shift to working from home has led to a surge in sales of screens, printers, scanners and webcams. These sales were 100% online since the physical stores were closed. This sudden investment will logically dry up the natural demand for these products. The need for physical stores, when they reopen, will be lower. It is also worth noting that in France, retailer FNAC-Darty, a specialist in sustainable consumer goods (780 stores worldwide) had to ask for help from the French government to guarantee a €500m loan. The managing director of FNAC-Darty, Enrique Martinez, is not mistaken. He says on French radio Europe 1 that the increase in online sales is not compensating for the drop in in-store purchases and that he expects an overall decline of 30% during March.

Consumer electronics sales during Covid-19: contrasting trends

In Spain 3 products are particularly benefiting from the crisis:

- Printers: +178%

- Laptops: +41%

- Consoles: +173%

In Italy, there was an 8.8% increase in sales of equipment goods (source: GSK).

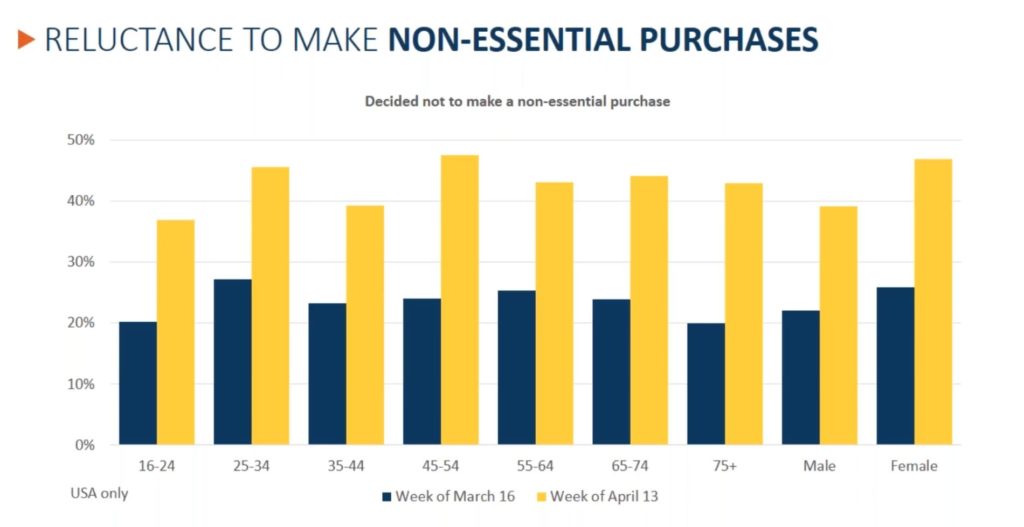

In the end, rising unemployment and falling incomes will affect demand for all aspects of consumer goods. But we may wonder whether some sectors could fare better than others (see below).

IMPACT 2: the clothing industry as the first casualty

The clothing sector is suffering from all the drawbacks of the Coronavirus crisis. Nikki Baird lists 3 significant problems:

- Obsolete stocks: the items currently in stock are outdated, take up unnecessary space and make it impossible to prepare for a possible reopening of outlets.

- The fragility of some distributors: some American distributors were already in the red before the crisis. If they were to close, a sales channel would be lost.

- Supply difficulties: retailers can only obtain supplies in limited quantities. Items will be in short supply when the market reopens because supply chains are seized up (closed borders prevent imports from low-cost countries: Mexico for the North American market, Asia and the Maghreb for Europe). Cotton export figures from Uzbekistan (the world’s leading producer) will have to be carefully studied as they will determine the capacity of the production chain to restart.

In Spain, the clothing sector is expected to lose 40% of its turnover in 2020.

Added to these problems is the fear of contamination. As Dominique Michel, CEO of Comeos, pointed out, “who wants to try on a piece of clothing that might be contaminated? There is, therefore, an essential challenge for the clothing sector to propose solutions that will enable it to respond to consumers’ fears. The decontamination of clothing could become an insoluble puzzle for clothing specialists. What solutions can be applied to reassure customers without damaging products? We believe that scanning solutions have a bright future ahead of them. Initially designed for online purchases, they could well find unexpected new application in the non-food retail offline world.

Who wants to try on a piece of clothing that might be contaminated?

Dominique Michel, COMEOS

Scanning methods in the clothing sector

3D Scanning is already widely used in the method sector. Amazon, for example, uses it to define its collections based on the typical morphology of the entire population. It is therefore not a matter of taking individual measurements, but rather a state of the average morphology of the population at a time t.

The Belgian company Treedys aims to offer a precision of +/-2 cm with its mobile application (announced for 2021). This application will allow people to scan their body at home without having to go into a scanning booth.

Zozotown has launched Zozosuit, a connected fitting garment for taking measurements. The flop was quite total. The accuracy of the measurement was announced to be +/- 1 cm. In reality, it was much more. Yet Levi’s announced a collaboration with Zozo.

Augmented reality solutions, on the other hand, make it possible to try on ‘virtually’, several garments before actually trying them on. A solution like Treedys, which we had as a client, increases the probability of choosing the right size.

We, therefore, believe that the rescue of the clothing sector will require technological investment to reassure consumers. The rhetoric may be challenging to hear in the current period (cost reduction), but as early as 2021, we believe that targeted investments can once again be on the menu.

IMPACT 3: some non-food retailers may be less affected

We anticipate that a few specific non-food retail- firms will suffer less than others: those with a link to home furnishing and those that offer an essential advice dimension.

Home furnishing

The role of the home (in a general sense) is changing. People now spend all their time there with their loved ones. More than ever before, the house becomes a protective cocoon that we need to develop to regain a little courage and energy, and also, incidentally, to work more efficiently. We believe that DIY stores and garden centres will experience a revival of interest. In Italy, the Interflora network is seeing an explosion in demand (online demand, since florists are closed) for balcony plants. Morale is at half-mast, and flowers bring comfort and a change of scenery. In Belgium, the reopening of DIY stores on 19 April 2020 has been very popular, generating endless queues. The DIY stores also have for them to sell products for which advice is often needed. This advice is absent from the online dimension and therefore reinforces the offline anchoring of DIY stores. The next 3 years could consequently prove to be a prosperous period for DIY stores. To build customer loyalty, they will have to ensure that they offer solutions to support the DIY sector. The deteriorating economic situation and increasing unemployment will lead many people to start DIY to reduce costs. New solutions have yet to be invented in this field to help these new do-it-yourselfers.

Statistics: Sales of gardening equipment during the COVID 19 crisis

During the confinement, online sales of garden products on Amazon increased by +44% in Italy, +35% in Germany, +9% in the USA (source: sellics).

Opticians

The “advice” dimension is very present in the work of opticians. This dimension is not easily transposable to the online world. Moreover, the needs met by opticians are not correlated with economic cycles. Finally, as contact with opticians is punctual, the number of customers at the sales outlet can be more easily regulated than in food retail, for example, we believe that this vertical will not be affected by the COVID19 crisis.

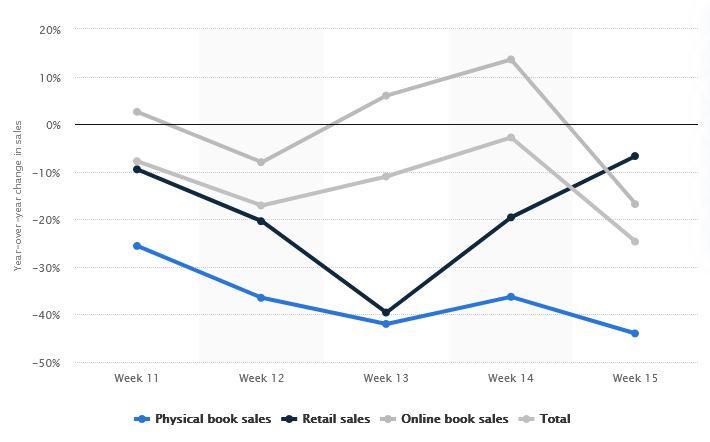

(Very) specialised bookshops

Retreating into the family cocoon could be fertile ground for regaining the pleasure of reading. While Amazon has become an indispensable solution to this need, we know that more discerning readers need advice. This dimension is a driver of customer loyalty, as Marc Filipson, owner of the world’s largest single-level bookstore, explained in an interview. At the end of March, the Guardian in the UK reported a 35% increase in book sales. However, this upturn is not observed in other countries. In Sweden, for example, sales fell by 24.7% across all channels in week 15/2020. Only weeks 13 and 14 showed an increase in online book sales; the other sales channels have been negatively affected since the beginning of the crisis (see graph below, source Statista). Not all booksellers will survive this crisis; the most substantial and least specialised booksellers will suffer the full force of the crisis. The weight of the stock will be felt and will further weaken its financial structure. Specialised bookshops might do better, but again, there is no guarantee.

The luxury sector

The luxury sector is a particular segment of non-food retail that has experienced dynamic growth. The luxury sector is $247 billion in turnover in 2018, an 11% increase in 2018 and 3 French companies at the top of the ranking: LVMH, Kering and L’Oréal Luxe. Instead, should we use the past when talking about these figures, because the luxury sector (LVMH in the lead) has seen its growth driven by Asia. If the latter is already doing better in terms of health (deconfinement has begun), Europe, which used to welcome Asian tourists, is still in turmoil. The luxury goods sector will be struck by the setbacks in the air transport sector on the one hand, and the tourism sector on the other (hotels, restaurants and museums will be closed for many more weeks). Sales will only be possible in local outlets in Asia at first. Beware of luxury brands that were counting on tourist purchases in Europe. The reopening of the Hermès store in China ended with the best sales ever achieved in a single day, proof that the need to consume is very much alive. After a prolonged period of confinement, it is conceivable that consumers will “let go”.

Here is the medium-term outlook (all of 2020 but also part of 2021). One can also wonder about the welcome that will be reserved for Chinese tourists in the longer term and the effects on their spending habits of possible stigmatisation of Chinese tourists.

Stigmatisation of Chinese tourists: what effects on non-food retail?

Donald Trump talked about “Chinese virus” for weeks before he backed off. According to CNN, this has had a stigmatising effect. Despite recent semantic changes (he now talks about the invisible enemy), the grey areas that remain over the emergence of this virus continue to fuel controversy. In the United States, the state of Missouri has decided to take China to court. One can legitimately wonder whether Chinese tourists will still want to return to visit countries where they will feel stigmatised. The question of the effects of stigmatisation was put to the President of the United States at a press conference (see video below).

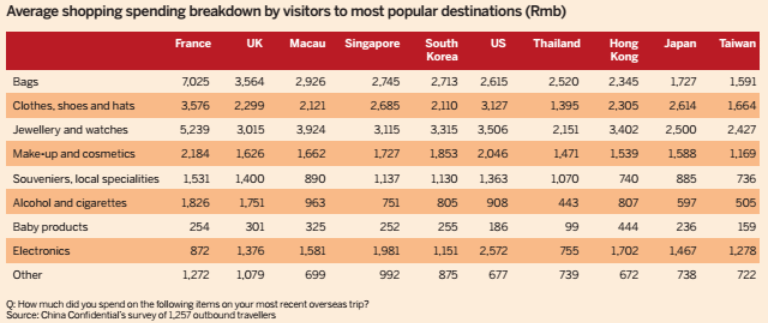

These negative feelings concerning the old continent could have dramatic consequences for the tourist industry of course, but also for retailers active in the luxury goods niche which would see a significant source of turnover dry up. A 2014 study shows that Chinese tourists in France spend an average of $8000 on luxury products (see details below).

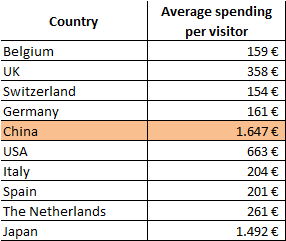

However, this figure is not in line with a study by the Banque de France, which speaks of average spending per Chinese visitor in 2017 of around €1647, ahead of Japanese tourists (€1492). Nevertheless, and for comparison, this is twice as much as American tourists, and 10x more than German tourists. The contribution of Chinese tourists is therefore significant for French retail.

Average spending amounts per foreign visitor in France (2017, source Banque de France)

IMPACT 4: health security will remain a strategic issue until 2021-2022

As in the food retail sector, customer safety will remain a strategic issue for a long time to come in non-food retail. It can even be said that in the short term (that is to say until the end of 2020), health safety will be the only operational priority for retailers and probably also their single investment item.

As in food retailing, health safety will represent a significant challenge for non-food retailers. Some specific problems will also have to be addressed, for example, in clothing (see paragraph above).

The solutions already put in place by food retailers will, of course, be applied as soon as non-food retailers reopen their sales outlets.

The solution tested by Carrefour since 22/04/20 in its sales outlet in Mont-Saint-Jean, Belgium (see illustration opposite), could predict what a structural solution could look like. This solution, which is compact enough to be installed even in small commercial outlets, also has the advantage of successfully regulating flows. However, this flow regulation will be a crucial operational aspect of the post-COVID19 era. If poorly managed, it will cause problems in the store and further reduce profitability per m².

IMPACT 5: shopping centre abandonment

We anticipate, at least until the end of 2020, a disaffection of shopping centres, which concentrate a lot of the non-food retail shops. All of the points of sale located there, whatever their speciality, will suffer more than the average. Counting and flow regulation solutions will have to be put in place to guarantee a minimum level of security. In particular, this will require ground markings indicating the direction of traffic. Shopping centres will also have to implement real-time flow management solutions to calculate the concentration in different spaces. While barriers equipped with photoelectric cells may seem as the most easily deployable solution, we believe that beacon-based solutions (see explanations in the insert below) are economically and technically far more advantageous. Managers such as Unibail-Rodamco have already installed beacons to analyse the customer’s route (Bluetooth link with the shopping centre’s mobile application). Implementations of this type are therefore bound to multiply shortly.

The Beacons Technology in Shopping Centres

Beacons, Bluetooth devices, are currently used in many shopping centres to push promotional messages to “mobinauts”. In doing so, it is also possible to reconstruct the routes of customers inside the shopping centre. The technology is not new, is inexpensive and has been deployed on a large scale in the United States for the past 5 years.

Regardless of the technological solution chosen, substantial investments will have to be made by shopping centre managers. These investments cannot be passed on to tenants already weakened by the decline in footfall. We can even expect the bargaining power to be reversed. Shopping cells will become vacant following the cessation of activities, and the remaining signs will require the manager to make financial efforts on the one hand and operational and marketing efforts on the other to attract shoppers.

This situation is unprecedented and will affect managers’ balance sheets. While rents had risen by +3.1% for URW (Unibail-Rodamco), +6.2% for Carmila (Carrefour Group) and +3.6% for Mercialys in 2019, we can expect a decline in 2020.

To keep in mind

The disaffection will affect shopping centres but also busy shopping streets. The motivations will be the same and will relate to the anxiety caused by large human concentrations.

IMPACT 6: shop fittings and online services

A structural drop in traffic, at least until 2021, will cause the turnover per m² to plummet. Non-food retailers will come to wonder whether the sales areas cannot be reduced. To reduce their structural costs, some retailers will opt for smaller premises and reduce the depth of their offer. Stocks will be diminished, and therefore, immediately available items will become scarcer. There will be an accelerated transition to phygital stores. The shift to e-commerce will follow (or precede) this trend.

A point of sale like Made.com is an interesting illustration of what this phygital transition could look like in the furniture industry: smaller stores, no or very little inventory, immersive technologies to facilitate decision making while limiting in-store capital expenditures. Think about consulting our interactive map of the most innovative retail concepts to get ideas for the post-COVID 19 era. This map is updated twice a month.

The car dealerships will not be outdone. Moreover, they have long since converted to new technologies (stock reduction obliges), and ideas must also be sought in this sector to renew the customer experience. We will think for example of Audi City (showrooms in city centres) which uses a range of technologies, some of which are immersive; or the enhanced reality used in BMW showrooms (see video below).

This “down-sizing” will also have to take into account customers’ expectations in terms of space. Stores that are too small will be shunned, and retailers will have every interest in saving space by rearranging their sales areas.

From 2021-2022, these sales areas will be linked to an online offer (e-commerce). Retailers will be forced to make a change of pace. This will also concern the luxury sector. In a survey of its members, Comeos estimated that 54% did not practise e-commerce or practised it only to a limited extent. This situation will be untenable from 2021 onwards. The priority investments of retailers will be in building (or reinforcing) an e-commerce offer.

IMPACT 7: Coronavirus, a windfall for virtual reality?

When a visit to the store is essential to the purchase (think car, home furnishings, clothing), you can bet that the number of visits will be limited to a minimum.

Catherine Bendayan, a former CEO of IKEA Belgium, relates an experience conducted in 2016 by the Swedish furniture giant. Customers had the opportunity, thanks to a virtual reality headset, to view and use their future new kitchen.

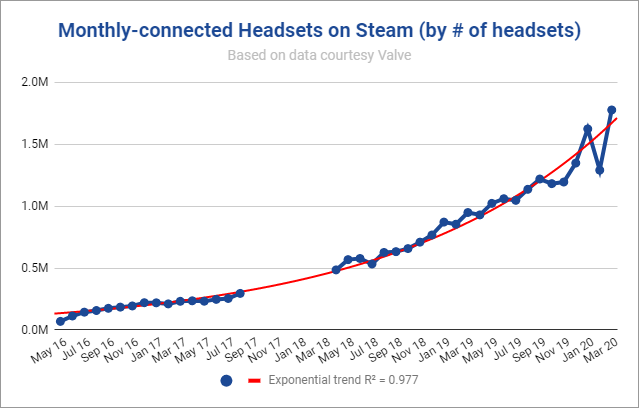

Virtual reality could well become a powerful ally to reduce trips to the store before a significant purchase. However, the technological skills of retailers and the rate of home furnishing would have to keep pace. Note, however, that the use of RV helmets on the Steam platform seems to have reached in March 2020 a higher level (read the article to understand why I use the conditional). This could reflect an increasing rate of virtual reality helmet usage (see graph below). To promote adoption by companies, the Taiwanese HTC proposes to make virtual spaces available, which could encourage the most technophile retailers to test this technology.

Alternative technologies, which do not require specific equipment, could also be used more widely. One example is enhanced reality, which is already well used by several major retailers, including IKEA.

In the clothing sector, we can anticipate the adoption of emerging technologies allowing remote measurement. Treedys’ solution could, for example, take advantage of the crisis (see the paragraph on clothing in which we analyse the technological solutions specific to this sector).

IMPACT 8: the customer experience more important than ever

From 2021 onwards, a new routine, new normality will be established. It is reasonable to think that we will have to learn to live with the virus. Life will resume very slowly, and non-food retail will again be able to keep marketing issues in mind from Q2/2021 onwards. We believe that the customer experience may become essential. Some dimensions will be more valuable than others.

The transition to “phygital” will be a strong component of tomorrow’s non-food retail customer experience. But beyond these technological aspects, tomorrow’s customer experience could see its 6 dimensions (affective, cognitive, physical, relational, sensory, symbolic) affected. Brands will have to strengthen their marketing proposals on specific aspects to become more productive.

The security dimension becomes a component of the customer experience

First of all, we think that the psychological after-effects of the coronavirus crisis will bring out an additional aspect: the need for security (2nd floor of Maslow’s pyramid). This is not yet covered in the 6 dimensions of the customer experience that have been scientifically validated. The customer experience measurement will, therefore, need to ensure that security and reinsurance are covered.

Reinforced relational aspects

After the period of confinement that we have just experienced, it seems more important than ever to insist on the relational aspects. This is not about digital CRM or Ersatz, but about human-to-human relationships. We have seen that confinement “brings us closer” (in the figurative sense of the term since we were isolated). When people come out of their homes after this psychological ordeal, the need for human relationships will be enormous. Sales outlet employees will play a key role in transmitting positive energy. A brand like Lush should be a big winner in the post-crisis period. Everything in this brand breathes positive: first of all, the products (see illustration below), but also the staff, who are always great at any sales outlet. In the Lush model, there are real lessons to be learned to prepare for the post-COVID19 period. To win in the post-COVID19 era, it will be necessary more than ever to surround yourself with employees who love customers. And as these qualities cannot be learned, they will have to be detected beforehand when recruiting staff.

Symbolic dimension of the customer experience

A question mark concerns the “symbolic” dimension of the experience. What does the brand mean to me? Real questions will emerge about how consumers will look at brands. Their needs will indeed be durably affected (cf. Maslow’s pyramid) with a focus on the lower levels. Will there still be room in the consumer’s brain to hear marketing messages using symbols that have become obsolete? Questions of social projection will fade away in favour of more basic needs. Fear of tomorrow will take over the cognitive resources of individuals. Complicated speeches will become inaudible.

Will there still be room in the consumer’s brain to hear marketing messages using symbols that have become obsolete?

Conclusions

In this study, we have tried to identify the likely consequences of the coronavirus crisis to the non-food retail sector. A total of 8 consequences could be sketched out, some more obvious than others. While all these projections remain conjecture, one thing is certain: the ” world after” will not look like what we experienced before the crisis.

Images d’illustration : shutterstock

Posted in Strategy.