What is the profile of people who invest in cryptocurrencies? Since the Covid crisis, cryptos have held a special place in the minds of investors. Many enthusiasts wanted to seize the opportunity for easy gains and jumped into bitcoin, Ethereum, and other cryptos. In this article, we detail the results of research that was realized in the United States. To complete it, we have asked the opinion of several specialists whose testimonies you will find at the end of the article.

Summary

- Introduction

- What are the most well-known crypto-currencies?

- What is the share of crypto-investors in the population?

- Does buying cryptocurrency depend on trust in the financial system?

- What is the profile of crypto-currency owners?

Introduction

The research published in 2021 by Raphael Auer and David Tercero-Lucas for the Bank of International Settlements (BIS) was based on a 2019 US population survey. The effect of the Covid crisis is therefore not reflected in the numbers. Yet, as I explained here, overly accommodative monetary policies have impacted the profile of investors (especially in crypto-currencies). So, keep this in mind when analyzing the results below.

What are the most well-known crypto-currencies?

If there is one thing that the crisis is not likely to change -too much- it is the knowledge of different cryptocurrencies among the general public.

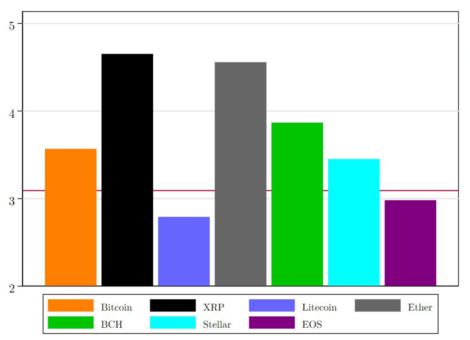

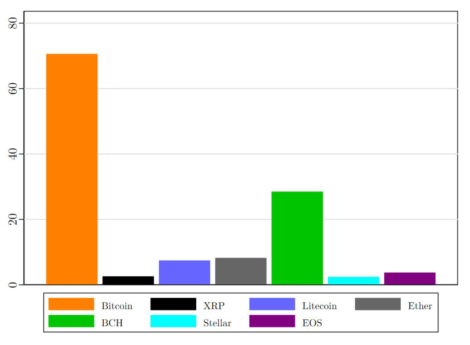

The survey realized using bitcoin in 2019 was a big hit. Nearly 70% of those surveyed knew about bitcoin. More surprising is the second place of BCH (bitcoin cash), known by a little less than 30% of respondents. In third place comes Ethereum (less than 10% of knowledge).

What is the share of crypto-investors in the population?

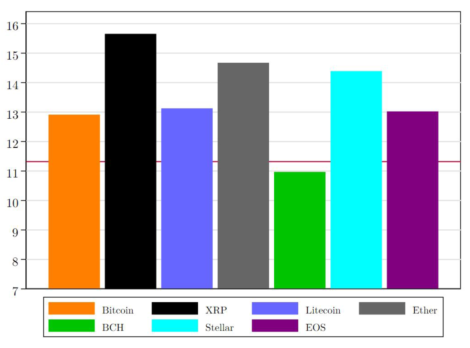

The survey provides an accurate picture of the percentage of the US population that had invested in different types of cryptocurrencies in 2019.

Bitcoin again remains the most popular crypto among investors. Despite this, only 1 in 100 respondents had purchased it. Ethereum represents the 2nd most owned crypto. About 0.6% of Americans owned it in 2019. Litecoin came in 3rd (0;5% of the population) while XRP, Bitcoin Cash, and Stellar had attracted the investments of 0.3% of the population. EOS closes the market with 0.1%.

The countries most addicted to cryptocurrencies

Projections for 2021 give the following 5 countries the top ranking by the number of crypto-investors:

- India (100 million)

- USA (27 million)

- Nigeria (13 million)

- Vietnam (5.9 million)

- United Kingdom (3.3 million)

The ranking is different if we consider the percentage of the population that owns cryptocurrencies:

- Vietnam (6.1% of the population)

- Thailand (5.2%)

- United Kingdom (4.95%)

- Brazil (4.88%)

- Pakistan (4.1%)

Do cryptocurrency investors have less faith in cash or the financial system?

The answer is no. The authors show that the request for crypto-currencies is not related to a confidence deficit in the currency or the financial system. This undermines the alleged “rebellious” nature of crypto-investors.

The opinion of Emanuel Erdem, Belgian Blockchain & Crypto assets Federation

The opinion of Emanuel Erdem, Belgian Blockchain & Crypto assets Federation

What effect did the Covid crisis have on cryptocurrency investment?

In March 2020, there was a slight drop during the first Covid wave, and after that, the overall interest in cryptos increased very quickly. Many people started working from home and asked themselves existential questions: how to secure their retirement? How to invest?

What does the average investor look for when buying cryptocurrencies?

New and often inexperienced investors expect rapid gains. This also means that they tend to sell at a loss as soon as the market falls. Many lose money this way. On the contrary, we try to take a long view of investing in digital assets in my community. A large part of the members invests with a horizon of several years.

What is the socio-demographic profile of the cryptocurrency investor?

Schematically, it is a 35-year-old man, married, educated, and earning a good living.

Notwithstanding the feminists, risk aversion (see Jianakoplos and Bernasek, 1998) leads to a natural imbalance. Men are statistically more likely to invest in crypto than women. 3% of male respondents owned one or more cryptocurrencies compared to only 0.8% of women. This gap has widened since 2017 when there was male/female parity.

Age is negatively associated with cryptocurrency ownership. In other words, when you get older, cryptos are less attractive. Cryptocurrency would therefore be primarily a “youth thing” if you’ll pardon the expression. In 2019 the average age of the crypto buyer was 35 (40 in 2018). If the target has become significantly younger, non-buyers see their average age remain relatively constant (47-48 years).

(Source: Auer and Tercero-Lucas, 2021)

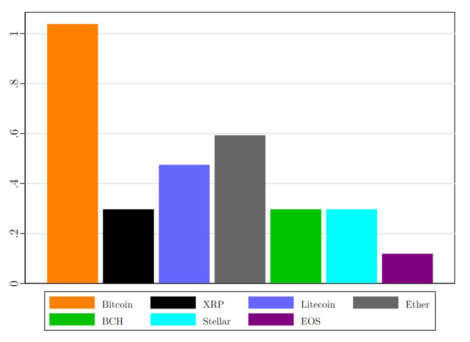

Finally, the level of income is correlated to the purchase of cryptocurrency. The purchase of this type of asset is primarily reserved for those who earn a good living. Moreover, notable differences depending on the crypto-currency itself. XRP seems particularly elitist in this regard.

The degree of digitalization: THE determining factor of the profile of the crypto-investor

Auer and Tercero-Lucas show that cryptocurrency ownership is very strongly correlated with the degree of digitalization of the investor. Simply put, the more accustomed a person is to using digital tools to pay, the greater the likelihood that they will invest in cryptocurrencies.

In the research, this degree of digitalization is measured according to 3 variables: the possession of a debit card, the use of a mobile application to pay, the realization of payment via PayPal in the last 12 months.

The opinion of Marc Toledo, founder of the Bit4You platform

The opinion of Marc Toledo, founder of the Bit4You platform

Do you notice any typical investor profiles on the bit4you platform?

There are no typical profiles. Instead, the population is very diverse and broad, from 18 to 75 years old. Some have a diversification policy, those who buy for the long term, those who buy to gamble, and there are the day-traders whose number is in solid increase since the Covid-19 crisis. Specific knowledge of the technology is not required. You have to be willing to understand how it can be used. Surprisingly, on the platform, more than 20% of women are the ones who are currently investing the most. Perhaps they are more thoughtful.

What are the reasons for investing in crypto-currencies?

Cryptocurrency is a form of diversification. It allows you to diversify your assets, a form of value storage. Moreover, it is uncorrelated with the real economy.

In Africa or China, crypto-currency is more than 10 years ahead of Europe. This craze is because crypto-currency gives people the opportunity to have a bank account, trade via the internet, and prevent people from being robbed.

Posted in Innovation.

25 April 2022

I am over 70yrs old, sub-urban South African citizen but interested in relatively fast yielding investments. The shorted maturity period with conventional investments is five years.

Which of the crypto digital assets would you recommend if I can handle the risk appetite involved?

30 April 2022

I wish I could help but I’m not a financial advisor I’m afraid