The Customer Lifetime Value (or CLV) is one of the best indicators to determine the value of a customer. It is very interesting to find the most profitable elements of its customer base. Nevertheless, the definitions of the concept differ according to the sources. However, our definition includes the most relevant scientific sources on the subject. In this article, we will also detail the calculation of the CLTV (click here to discover it). Finally, a numerical example will complete our analysis of this very useful concept in marketing automation.

Contact us to identify emerging trends in your industry

Summary

What is Customer Lifetime Value?

The CLV determines the number of future profits from a customer. It brings a lot to companies in allocating resources to their customers. Thus, it is limited to the duration of the customer relationship, i.e., the period between the first and the last expected purchase (Tukel & Dixit, 2013; Gupta et al., 2006).

Indeed, a consumer-specific Customer Lifetime Value determines which members of your customer base are best. This is why we recommend calculating it before any account-based marketing campaign. As a reminder, account-based marketing pushes brands to consider each key customer as a market share segment in its own right. Your marketing strategies become more impactful and judicious (Hiziroglu & Sengul, 2012; Safari et al., 2016). Nevertheless, it is possible to calculate the CLV for a homogeneous set of customers. Each structure has its optimal way of determining Customer Lifetime Value. (Haenlein et al, 2007)

Therefore, the CLV method is similar to the financial approach of discounted cash flow. But Sunil Gupta makes two fundamental nuances. First, CLV only assesses the value of a single customer or market segment. This means that the process relies on the differences in profitability from one customer to the next instead of determining average profitability. Secondly, the Customer Lifetime Value is particular in anticipating customer defection to the competition. In short, we are dealing with a more relevant indicator for measuring marketing efforts.

The place of Customer Lifetime Value in customer value

As you can see, CLV determines the value of a customer at a given time. However, Payne & Holt, 2001 state that other areas influence customer value. Taken together, all of these disciplines provide a better understanding of the customer’s motivations. In a way, this set constitutes a compilation of lines to satisfy better and retain customers:

- Set of fundamental values of the customer: companies must identify them to reach their marketing target better

- Quality of the customer service: it is moreover an important support to increase its Customer Lifetime Value

- Value creation process: at this level, do not hesitate to redouble your efforts to improve the perceived value of your offer

- Value of the customer in the eyes of the company: the CLV is the main indicator

- Relational value: make no mistake, relational marketing is a significant added value for customer loyalty. Nespresso has clearly understood this.

Predicting customer value through customer segment dynamics

The most recent research on CLV focuses on predicting fluctuations in customer value. In addition, Mosaddegh et al., 2021 rely on separating customers into 2 distinct audiences: initiators and followers. In doing so, the research models the evolution of customer behavior. Thus, its authors claim that brands using this methodology could well detect market trends. This recent finding is equally applicable to today’s dynamic markets.

Our market research firm analyzes customer behavior in depth

In addition, Dr. Mosaddegh says that customer value can only be calculated with customer-to-customer associations. In other words, it is necessary to recognize the influence of initiators on followers. Thus, customer segments are dynamic: they should be a new indicator of Customer Lifetime Value. According to the results of this research, this would be an ideal way of adapting to changes in the customer market.

New market developments need to be researched to understand customer value.

Calculating Customer Lifetime Value

By now, we all know what Customer Lifetime Value is all about. It’s time to look at its method and detailed calculation. It is based on three key variables:

- the average basket per customer

- the lifetime of the customer

- and the frequency of consumption

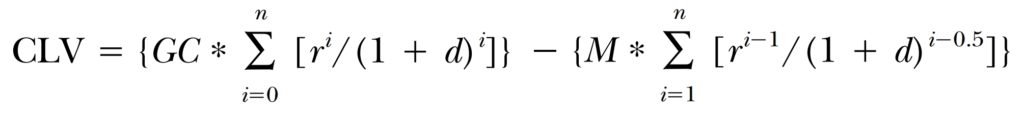

Without further ado, here is the CLV formula for each of your customers/market segments. There are several ways to calculate this value. Nevertheless, we propose you research the equation from Berger & Nasr, 1998. In literary terms, CLV is the time evolution of the customer’s value, considering:

- customer retention

- discounting

- and the operational costs incurred by customer acquisition (advertising, prospecting, inbound marketing, and so on)

Here’s a look at the formula from Boston University residents Paul Berger and Nada Nasr:

Find below the meanings of the letters and symbols previously discussed:

- GC: annual gross profit per customer, i.e., sales revenue minus its cost

- i: time (i=0 being year n, i=1 being year n+1, and so on)

- Σ: sum of positive or negative inflows from a customer over 1 year. We start at period i=0, where “n” is the number of years we would like to research

- r: retention rate from one year to the next, for example, 50% if we go from 40 to 20 customers between i=0 and i=1

- d: discount rate, a kind of exchange rate that takes into account changes in pricing, for example

- M: annual marketing costs for a given customer

Example of the application of the Customer Lifetime Value

Finally, to simplify the understanding of the previous equation, we propose a practical example of Customer Lifetime Value calculation.

We would like to measure the CLV of a B2C company subject to strong competition. Thus, over 2 years (n=2), its retention rate does not exceed 50% from one year to the next (r=0.5). We assume that the discount rate is 10% (d=0.1) and that a customer brings 100€ per year to the company (GC=100). As for the marketing costs per customer, they amount to 20€ per head (M=20).

We then obtain:

CLV = [100 * (1 + (0.5 / 1.1) + (0.25 / 1.21)) – 20 * ((1 / √1,1) + (0,5 / (1,1) ^ (3/2)))]

CLV ≈ €138.38

How do we interpret this result? In concrete terms, the lifetime value of this customer, bringing in €100 for €20 of marketing spend, is €138.38. All that’s left is to repeat the experiment to determine your best customers and market segments!

Sources

- Berger, P. D., & Nasr, N. I. (1998). Customer lifetime value: Marketing models and applications. Journal of Interactive Marketing, 12(1), 17–30.

- Gupta, S., & Lehmann, D. R. (2003). Customers as assets. Journal of Interactive Marketing, 17(1), 9–24.

- Gupta, S., Hanssens, D., Hardie, B., Kahn, W., Kumar, V., Lin, N., Ravishanker, N., & Sriram, S. (2006). Modeling Customer Lifetime Value. Journal of Service Research, 9(2), 139–155.

- Haenlein, M., Kaplan, A.M. & Beeser, A.J. (2007). A Model to Determine Customer Lifetime Value in a Retail Banking Context. European Management Journal, 25(3), 221-234.

- Hiziroglu, A. & Sengul, S. (2012). Investigating two customer lifetime value models from

segmentation perspective. Social and Behavioral Sciences, 62, 766-774. - Mosaddegh, A., Albadvi, A., Mehdi, M. & Babak Teimourpour, S. (2021). Dynamics of customer segments: A predictor of customer lifetime value. Expert Systems with Applications, 172.

- Payne, A., & Holt, S. (2001). Diagnosing Customer Value: Integrating the Value Process and Relationship Marketing. British Journal of Management, 12(2), 159-182

- Safari, F., Safari, N. & Montazer, G.A. (2016). Customer lifetime value determination based on RFM model”. Marketing Intelligence & Planning, 34(4), 446-461.

- Tukel, O.I. & Dixit, A. (2013). Application of customer lifetime value model in make-to-order manufacturing”. Journal of Business & Industrial Marketing, 28, 468-474.

Posted in Marketing.