Thanks to Covid young people have turned mainly to the stock market to invest their money. Beyond crypto-currencies, primarily abandoned by older investors, we can see that a fresh wind is blowing on the stock market. The younger generations are shaking up the investment codes, and several Market Research studies shed light on these changes.

Young people and the stock market: some statistics

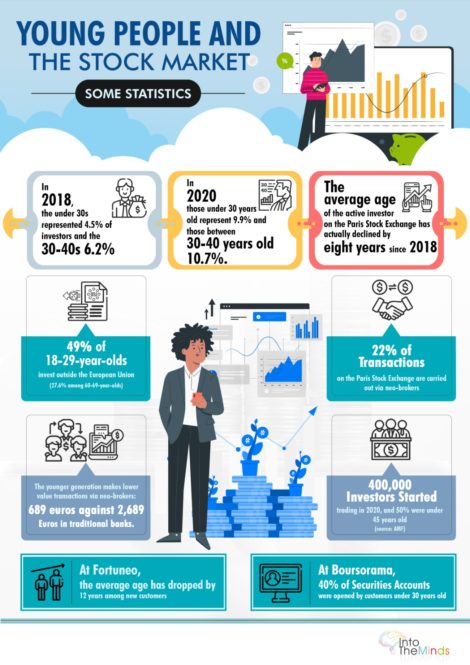

- In 2018, the under 30s represented 4.5% of investors and the 30-40s 6.2%

- In 2020, those under 30 years old represent 9.9% and those 30-40 years old 10.7%.

- The average age of the active investor on the Paris Stock Exchange has actually declined by eight years since 2018

- 49% of 18-29-year-olds invest outside the European Union (27.6% among 60-69-year-olds)

- 22% of transactions on the Paris Stock Exchange are carried out via neo-brokers

- The younger generation makes lower value transactions via neo-brokers: 689 euros against 2,689 euros in traditional banks.

- 400,000 investors started trading in 2020, and 50% were under 45 years old (source: AMF)

- At Fortuneo, the average age has dropped by 12 years among new customers

- At Boursorama, 40% of securities accounts were opened by customers under 30 years old

Market research shows a rejuvenation of stock market investors

It would seem that the stock market has regained some color thanks to Covid … and to the interest that the younger generation has found in it. Indeed, new behaviors have appeared, driven by a young generation (18-29 years old) that breaks the codes and uses the latest tools to invest. A few figures from FSMA and AMF studies help understand the extent of the phenomenon.

This rejuvenation can be seen in the average age of the Paris stock market investor: it has dropped by 8 years between 2018 and 2021! While in 2018, only 4.5% of stock market traders were under 30, this percentage has more than doubled in 2020 (9.9%). The increase is of the same order in the 30-40 years old segment, which goes from 6.2% to 10.7%.

This rejuvenation also leads to a change in other metrics. For example, we see that small transactions gain in volume as younger people invest smaller amounts. This is particularly visible in their use of neo-brokers, where the average investment is 4 times lower than via a traditional bank (€689 vs. €2689).

The Covid effect on stock market investments

The lock-down during the Covid crisis had an unexpected effect on stock market investing. On the one hand, the post-Covid collapse of the market has encouraged some amateurs to enter the stock market. On the other hand, the availability of time combined with savings has been a lever for a new generation of stock market players.

In the United States, it is a natural phenomenon that we have witnessed. Joe Biden’s stimulus checks (up to $1400 per person depending on income) have found surprising use. Before their distribution, a study by Mizuho Securities estimated that 10% of the aid (about $40 billion) could be invested in the stock market. Deutsche Bank had warned that 25-34-year-olds were the most likely to invest their “stimulus check” in the stock market, especially in crypto-currencies. This prediction was confirmed (see our study on the profile of crypto-investors).

This massive entry of neo-investors, while it has rejuvenated the sector, has also changed its practices. The phenomenon of “meme stocks” is undoubtedly a symptom of this.

Role of the neo-brokers

The neo-brokers are applications that break the codes of the stock market investment. On the one hand, they offer unbeatable rates compared to traditional banks. On the other hand, they provide a superior customer experience to conventional banks.

Centered around a mobile application, the neo-brokers allow the monitoring of prices and investments and offer a wide range of products. The mobile application is designed as a fun tool and undoubtedly contributes to the demystification of stock market investing.

Contact us for your market research

Neo-brokers also adopt an innovative marketing strategy, in contrast to the clichés conveyed by traditional banks. The use of influencers (also called “finfluencers”) is not without ethical problems. Some of them do not take the necessary precautions when promoting their sponsor. A French influencer (Nabila Vergara) was fined 20,000€ for not informing her followers that her posts promoting bitcoin were sponsored.

Since February 17, 2022, in Spain, personalities and companies followed by at least 100,000 followers on a social network must comply with strict rules for their advertising campaigns. These campaigns must be approved by the regulators at least ten days before they start. The footballer Andrès Iniesta, acting for the platform Binance, was also pinned by the Spanish regulator.

Tech effect

The last effect is tech. Interest in investing in the stock market has undoubtedly changed since the emergence of tech companies. Record highs in the stock market have been driven by tech companies for which the younger generation has a natural affinity.

This dominance of tech is visible in the indices:

- 40% of the S&P index is made up of technology stocks

- the weight of tech has been multiplied by 3 in the CAC40 index (source)

Conclusion

The profile of stock market investors is changing dramatically. This is the result of the convergence of several factors:

- the rise of stock market indexes attracts a new audience

- the gamification of investments (via neo-brokers) which attracts a new audience

- a Covid effect that has led to the investment of part of the compensation revenues

We should not overlook the disruptive aspect of neo-brokers. Their impact on investment tools will be felt for a long time. It is legitimate to expect that their user experience will spread to traditional banking in the medium term.

Posted in Marketing.