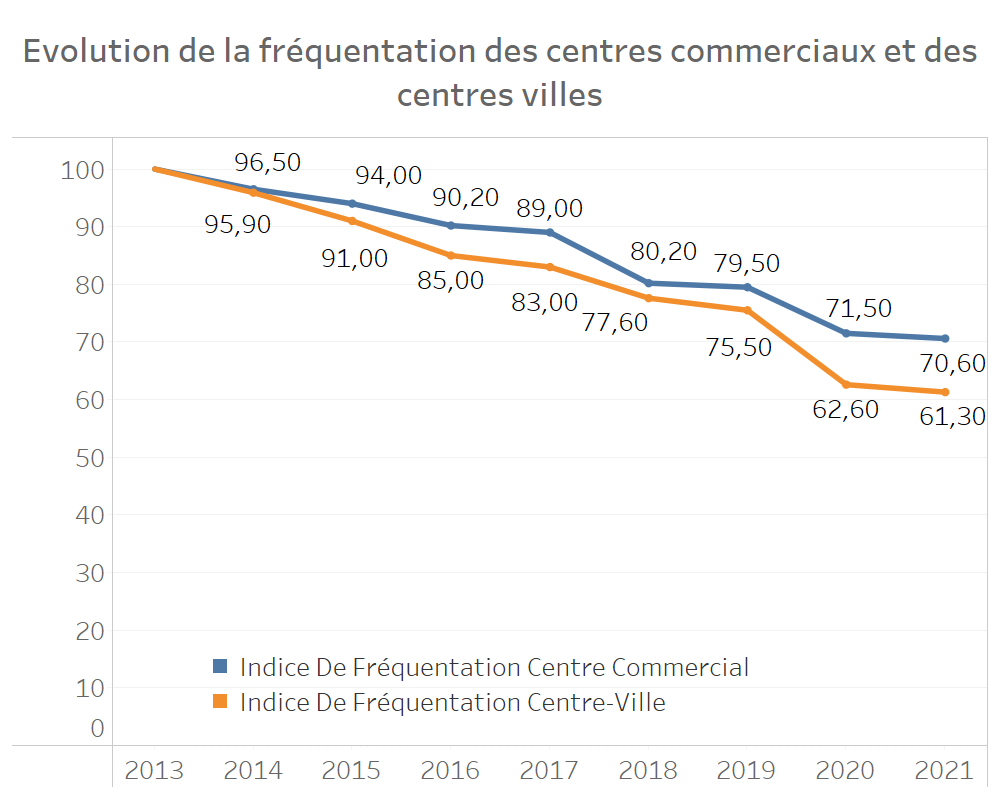

While the frequentation of “physical” stores is in free fall (-40% in 8 years, with a further decline of 30% since 2022), we can reasonably wonder about the evolution of the following years. The Covid crisis has caused an actual drop in traditional trade, and 2022 looks bad (inflation, war in Ukraine). Our analyses allow us to identify 3 strong trends which will determine the evolution of the frequentation in the following years:

- digitalization of food shopping and the breakthrough of low-cost

- the customer experience

- location

Statistics: the decline of physical commerce

- -29.6%: the decline in shopping center traffic between 2013 and 2021

- -38.7%: the decline in shopping center attendance between 2013 and 2021

- -31.1%: the decline in shopping center traffic in 2022 compared to 2021

- -28.5%: the drop in traffic in city centers in 2022 compared to 2021

The statistics for physical stores (downtown and in shopping centers) show a constant erosion (see graph below, 2013 serving as base 100). We can see the effect of Covid and the sharp drop-off in 2020 and 2021.

2022 is off to a very bad start (-31% for shopping centers, -28% for downtown stores). We believe that 2 factors will consolidate this trend of sales outlet desertification.

Factor 1: inflation

The February data, already available, shows a rapid deterioration in sentiment due to the geopolitical situation. The acceleration of inflation in January, and the end of the comforting Christmas period, is causing a decline in household morale (see here the figures for France). Significant purchases are being postponed, and the willingness to save is increasing. In the United States, the same trends can be seen in the University of Michigan’s confidence index. Compared to January, the decline in US household confidence is 6.5%, and over one year, it reaches 18.2%.

The tense geopolitical situation will increase energy costs and inflation and continue to weigh on confidence.

Factor 2: changes in food delivery habits

Like remote working, digitalization has experienced an unprecedented acceleration, particularly in e-commerce. European consumers are rapidly adopting food delivery.

The statistics on food delivery show a profound change in habits:

- +140% of spending with aggregators (UberEATS, Deliveroo)

- +175% of spending on home delivery baskets (notably Hello Fresh, which we have already discussed here)

- +35% for pure delivery players

- +13% for delivery via food superstores

- +86% for quick merchants (Gorillas, Kol, …) who have signed very nice fundraising deals in 2021

Physical retail: what to expect in the future?

In the light of the statistics on the evolution of the frequentation of physical stores, we can reasonably wonder about the change of “real” stores. To anticipate this evolution, we base ourselves on our future research on retail trends.

We have identified 3 main topics that will be decisive in the next few years regarding the frequentation of physical stores.

Food shopping: a convenience

Technological solutions and the uberization of the workforce bring solutions at acceptable costs for consumers. We can thus eliminate the drudgery of shopping. Our analyses allow us to anticipate a “commoditization” of food shopping.

Under the pressure of inflation, the impending financial crisis could be a driver for changing habits. This is supported by the ongoing price negotiations and the passing on of price increases to customers.

We, therefore, anticipate a shift in food purchases to low-cost supermarket distributors at the expense of traditional players. The consumption of more expensive organic products will stagnate or even decrease as in 2021, which will weigh on local stores specializing in this niche.

The customer experience as a support to the frequentation

The customer experience is going to drive the traffic to physical stores. Like shopping malls, which are eroding less quickly than downtown stores, consumers will be motivated by a unique experience.

Consumers will therefore give priority to destination stores. In the coming years, we will see a clear divergence between:

- stores that propose an experience and that will continue to be frequented. This experience will necessarily be linked to the positioning of the sales outlet.

- stores that fall into the “commodity” category and will see their customers move more and more towards online.

Differentiation, the connection between the real and the virtual world (phygitalization), will therefore subject the survival of physical stores to be decided.

Premium locations are more important than ever

In line with the first two topics, we believe that premium locations will increase their value in the coming years. In particular, tourist traffic vectors will be the most coveted, to the detriment of business areas, seeing their traffic and value decrease.

We can see that rental vacancies are significantly lower in high-tourism areas. In Paris, for example, the vacancy rate on June 30, 2021, was 9.7% on the Champs-Elysées and 5.4% on Avenue Montaigne. On the other hand, it reached nearly 15% on rue de Rivoli and 20% on boulevard Saint-Michel.

Luxury shops, grouped on specific arteries, will continue to be focal points for tourists and contribute to the frequentation of surrounding stores.

Posted in Strategy.