We would have almost forgotten it. Yet Covid will have changed our habits and the economy. Some Covid winners are now the losers of 2022. The 2023 trends show that the situation will stay the same. The crises we are going through (Covid, energy, war in Ukraine) are all jolts that destabilize consumers and disrupt economic ecosystems. We have identified 7 industries in the eye of the storm in 2022.

Contact our market research firm

Figures and statistics on post-Covid declines

- -17.5%: computer sales will fall below 280 million units in 2022 after a record 340 million in 2021.

- -17%: the contraction of e-commerce sales in the second quarter of 2022

- 15% of sales are made online, and e-commerce could represent 25% of sales within 5 years.

- Online sales are still 1/3 higher than before the Covid crisis

- +18%: the increase in the book industry in 2021 in France

- -8%: the decline in book sales in France since January 2022

- -4.8%: the decline in book sales in the US over the first 9 months of 2022

- The DIY sector experienced double-digit growth (up to 50% in the UK, 23% in France) during the Covid. A decrease is observed in 2022, but the sector still has good prospects because of the decrease in purchasing power.

- After a 2 to 3-digit growth in 2020, the demand for home furnishings is slowing down. Demand is expected to remain weak until at least 2025.

Summary: 7 markets that are suffering from the post-Covid era

1) -17.5% for the sales of computers in 2022

Not so long ago, there was a time when it became impossible to get a webcam, and computer components were unobtainable. Graphics cards were sold to the highest bidder, boosted by a trickle of supply and a bitcoin price that drove miners to invest crazy amounts of money.

This was an almost miraculous time for computer manufacturers whose sales had been steadily declining for 10 years. While in 2019, computer sales plateaued at 262 million units, remote working had caused the need to soar to 340 million by 2021. That’s an increased demand of nearly 30% in just 24 months.

The war in Ukraine and the energy crisis brought a layer of uncertainty and cost streamlining. As a result, computer sales are down massively for the fourth consecutive quarter in 2022. In the third quarter of 2022, the drop was 19.5%. By 2022, with deconfinement and a return to the office, the trend has reversed. In 2022, the market is expected to reach 280 million units or less, corresponding to an annual decline of 17.5%.

2) Video games

The video game sector was one of the winners of the Covid crisis. Today it is suffering for 2 reasons:

- disorganization due to remote working, which slows down the conception of games

- supply-chain problems that slow down the manufacturing of game consoles (especially the Play Station 5)

The purchasing power crisis adds a layer of uncertainty for the sector. The Christmas season, a key time for purchasing video games and consoles, will be different in 2022 than in 2021. Projections show that consumers will massively decrease their purchases. Even children will receive fewer gifts, which does not bode well.

3) Book sales: The wind has changed

A return to the self and a rediscovery of reading accompanied the confinement. As a result, bookstores were considered essential retailers in many countries and remained open. A shift in cultural spending took place in 2020 and 2021, leading to a substantial increase in book sales. The French, for example, bought two more books on average in 2021 than in previous years. This led to an 18% increase in sales in 2021 compared to 2020.

In 2022, however, this beautiful growth has stopped. Sales are down by 8% since January 2022. In the United States, the decline is also significant, reaching -4.8% in the first nine months of 2022.

4) E-commerce: 2 steps forward, 1 step back

E-retailers have been the heroes of the Covid crisis. They allowed the consumer to continue shopping when the physical stores were condemned to close.

It is estimated that the Covid crisis has allowed them to gain 3 to 4 years of maturity in the e-commerce market. The share of e-commerce has risen from less than 10% before the Covid crisis to 15% in 2022. The projections announce 25% within 5 years, but everything will depend on the general context.

The adoption of electronic means of payment has also been greatly favored. Nevertheless, retailing is, first and foremost, a physical experience, and consumers have returned to the store after the crisis. Those who had bet on the death of physical commerce were heavily mistaken, which was predictable since e-commerce represents at most 10% of commerce in general. Since January 2022, e-commerce sales have contracted by 17%.

Amazon has announced 10,000 job cuts in the context of this deceleration of e-commerce. Some websites, such as Made.com, have gone out of business. Everywhere savings plans are being put in place to cope with this “predictable” downturn in the market.

5) Home deliveries

As soon as the Covid crisis began, Google searches showed a clear craze for home delivery. A company like Hello Fresh found itself thrust into the spotlight overnight.

With the return to face-to-face work, the time available for cooking has shrunk considerably. At the same time, the reopening of restaurants is helping to satisfy the need for out-of-the-ordinary food.

For prepared meal delivery platforms (UberEATS, Deliveroo, ….), 2022 could be a better year. Their trajectory is similar to e-commerce since confinements have dictated the uses. The maturity of this sector has certainly gained 2 to 3 years, but today, the backlash is brutal. Inflation has also entered the equation.

Food taken at home tends to decrease. In France, for example, 94% of food was eaten at home in 2019 (which included de facto home delivery). In 2022, this figure has dropped to 89%.

6) DIY

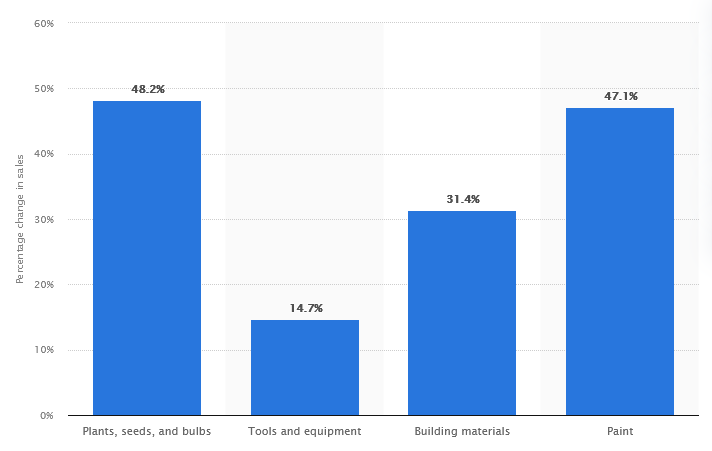

During the confinement, we all rediscovered our interior and the need to create a protective cocoon. Around the world, sales in home improvement stores have surged. In the UK (see chart below), growth has reached almost 50% in some departments. In France, the sector grew by 23% in 2020 and 2021. Research conducted for a French DIY store in 2020-2021 showed double-digit growth. In 2022 the decline is significant as sales will decrease by 6%.

The fall in purchasing power experienced in all developed countries argues for a “soft landing” for the DIY sector. The sector is resilient during crises because consumers seek ways to save money. But should we fear a further slowdown in 2023?

The energy crisis adds a layer of urgency to some jobs that should drive customers to their DIY stores in 2023. It will not be surprising to see a stabilization in 2023 or even a slight growth in the sector.

7) Household equipment

Following DIY, the home furnishings sector benefited from the Covid crisis. Consumers in all countries have been flocking to sustainable consumer goods to make their homes more livable.

Fitness equipment sales are up 170% in the US (see our feedback here), and home appliances were up another 7.6% in France in 2021. Remote working has driven the need, and sales of desks and office chairs increased by 438% and 300% in the UK in 2020 compared to 2019.

This over-equipment for a short period (2020-2021) has a direct consequence. As all purchases have been anticipated, consumers have no more needs to fill in 2022. The proof is in the soccer World Cup, which did not have the expected effect on TV sales.

In 2023 it may be the same thing. Although the delivery problems have been solved and prices have returned to certain normality, demand is expected to remain weak. Here it is the dual effect of declining purchasing power and over-equipment that is acting. And this situation will likely continue until 2025.

Posted in Strategy.