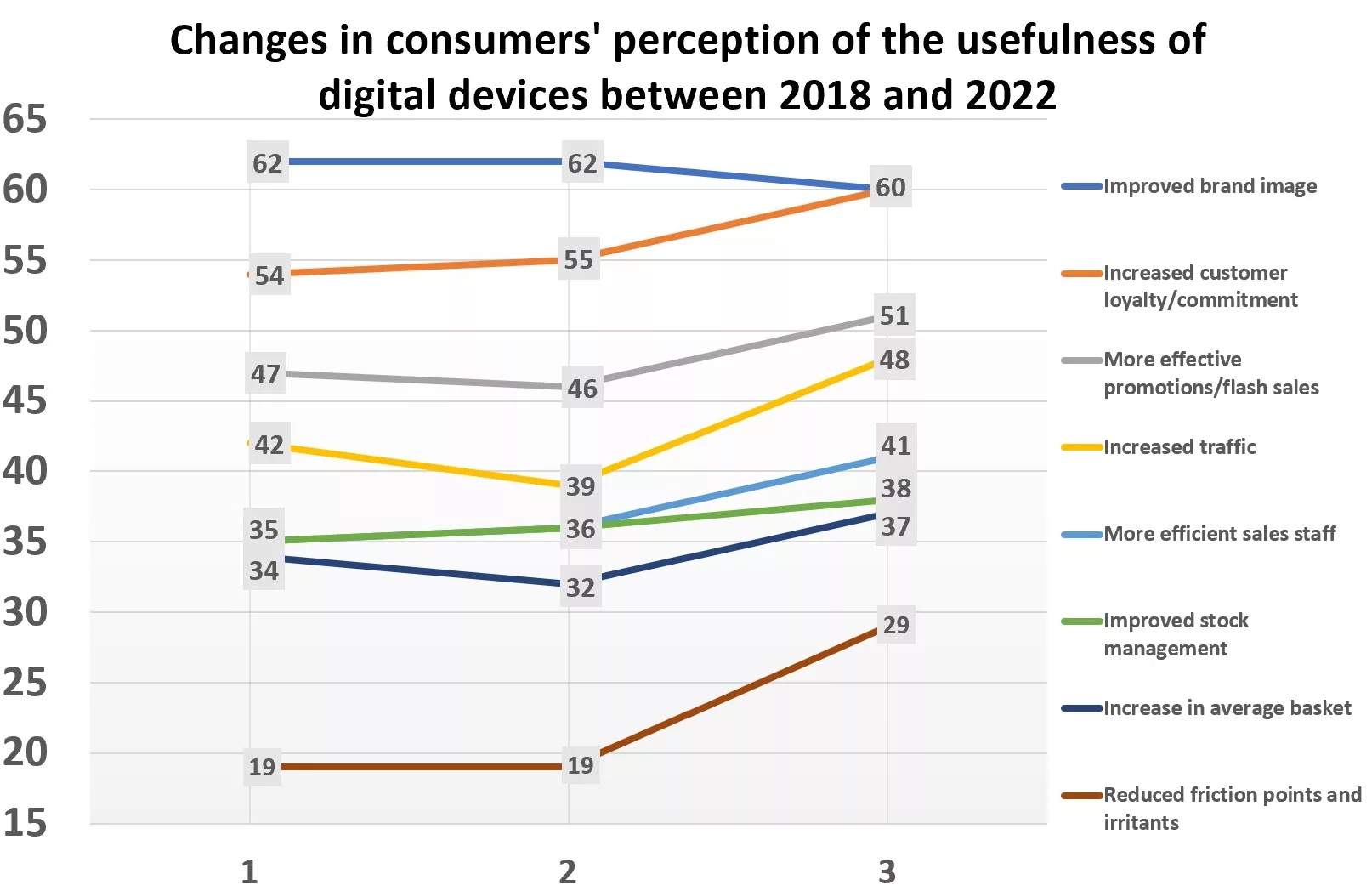

A survey, the results of which were revealed in April 2023, shows that consumers are less enthusiastic than before about digital equipment in physical sales outlets. At the same time, the research shows that digitalization is having a positive impact on retailer perceptions.

Digitization of sales outlets: 7 key figures (Survey April 2023).

- Between 2021 and 2022, consumer appetence for in-store digital devices dropped by 6 to 10 points, depending on the device.

- 45%of customers perceive the usefulness of mobile payment devices.

- At most, 1/3 of customersperceive the usefulness of all other in-store digital equipment (touch screens, connected fitting rooms, interactive window displays, personalized in-store advertising).

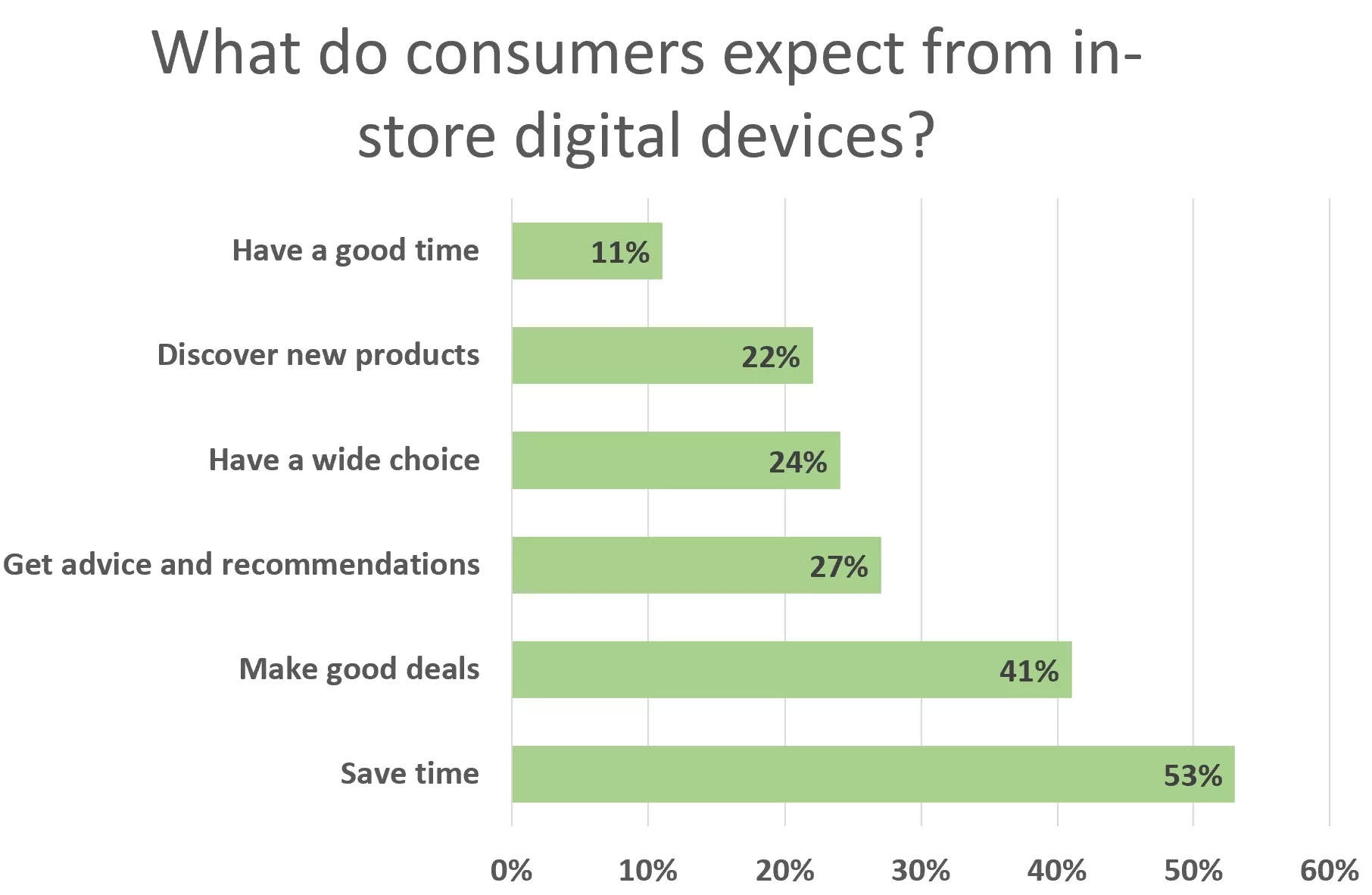

- 53%of customers want to save time with in-store digital devices, and 41% want a good deal.

- Interest in the other benefits of digital equipment is lukewarm, with at most 1/4 of respondents agreeing.

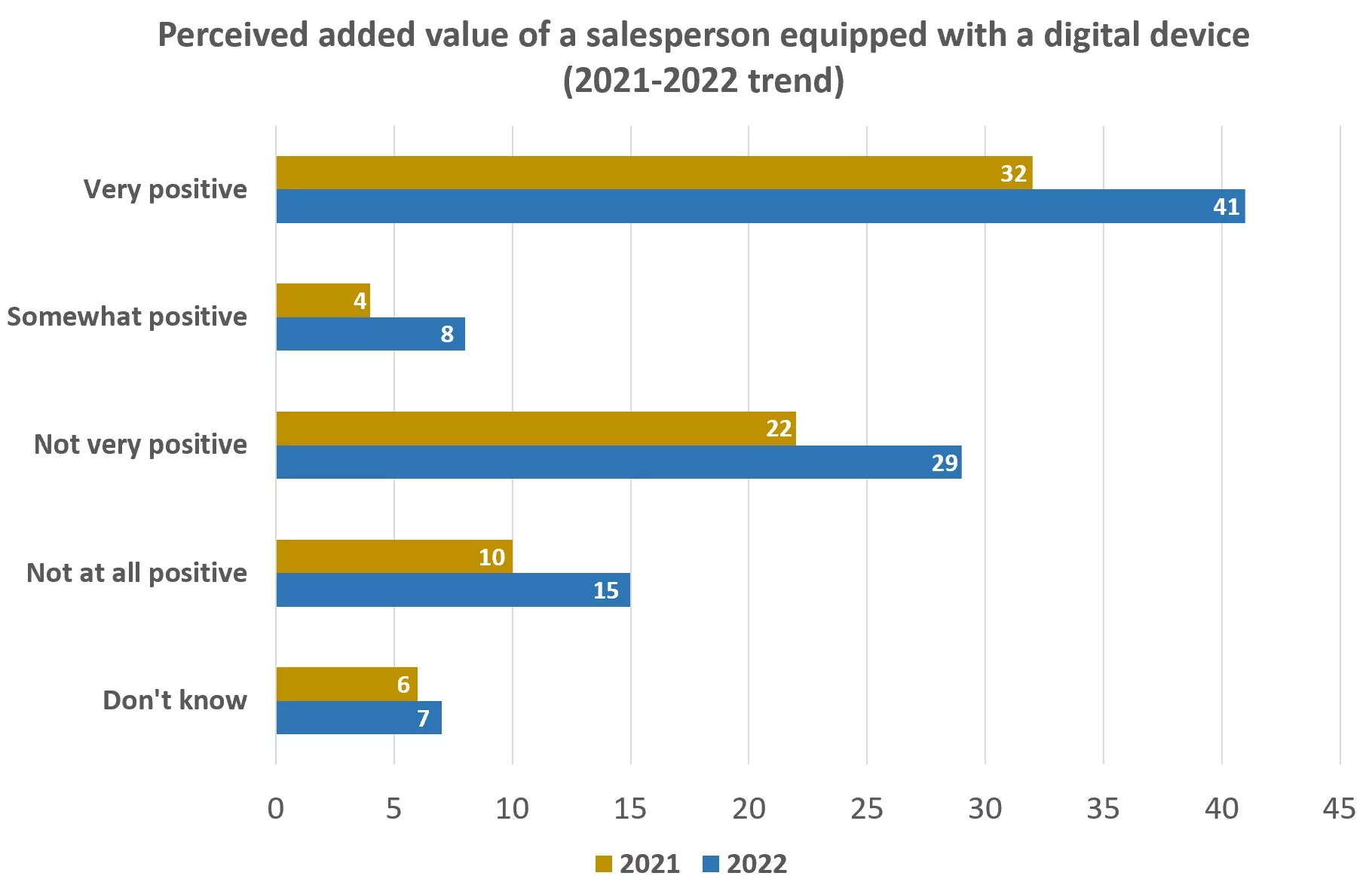

- 49%of respondents think a sales assistant “augmented” by a digital device will bring them added value.

In-store digital equipment: perceived usefulness declining

In recent years, retailers have invested in digitalizing their sales outlets. The idea was to improve the customer experience on the one hand and, on the other, to increase the efficiency of sales outlets (their yield per m²) by adding a phygital component. This has led to a proliferation of equipment. Mobile checkout (invented by Apple in its Apple Stores) has become popular, fitting rooms have become connected, touch screens and customers have been asked to check out themselves. Some stores have even become autonomous, thanks to an array of technologies worthy of Star Wars. Except that customers, once past the initial enchantment, have become pragmatic again.

The results of the April 2023 research show that consumer interest in in-store digital devices is in sharp decline. None of the digital devices tested in this Survey received a majority of favorable opinions. The most useful device is mobile checkout equipment for 45% of respondents. Touch screens (34% of respondents) and touch window displays (31%) are in second place. In other words, 2/3 of respondents don’t see the point of in-store touchscreen displays. Or rather, no longer see the point. The perceived usefulness of all in-store digital devices declined between 2021 and 2022.

Whereas 52% of consumers saw the usefulness of mobile payment devices in 2021, only 45% did so in 2022 (-7 percentage points in one year). The same applies to in-store touch screens (-6 points), touch-sensitive window displays (-6 points), virtual fitting screens (-8 points), and personalized on-screen advertising (-6 points). But the biggest fall is seen in connected booths, whose perceived interest drops from 40% in 2021 to 30% in 2022 (-10 percentage points).

Yet all these digital devices have become must-haves in sales outlet redevelopment. Our visit to Zara’s new flagship store on the Champs-Elysées in April 2023 proved the point. Fitting rooms had become connected, screens numerous and self-service checkouts ultra-sophisticated. A similar trend was visible in the Lacoste flagship store.

In 2023, we have entered an economy where two things are cruelly lacking: time and money. In-store digital devices must provide solutions to both problems.

Consumers in search of pragmatism

Why is interest in in-store digital devices waning? We must return to the Covid period and the forced transition from offline to online to answer this question. This transition made consumers aware of the possibilities and benefits of digital. Retailers were constantly striving to attract customers to their stores and bring these two worlds together. This convergence promised a better customer experience and better tracking of customers through their digital footprints. The number of devices multiplied, and consumers were delighted to discover all the new possibilities.

Once the novelty wore off, reality set in again. Today’s consumers want efficiency above all else. Their approach to the digitalization of sales outlets has become pragmatic once again. This can be seen in the graph below. It illustrates what consumers expect from in-store digital equipment.

The responses show a definite pragmatism. Most customers (53%) want to save time, the only resource they can’t buy. And in times of crisis, the other priority is to get a good deal for 41%. Beyond that, the other answers are almost anecdotal. They are cited by only 1/4 or less of respondents. Indeed, these crisis years are quite symptomatic that “having a good time” no longer seems to make sense in 2023. Almost 90% of customers do not associate digital devices with the pleasure of shopping. Once the enchantment of the early years has passed, digital devices have become tools like any others at the service of the transaction.

So where does digital fit in?

Does this mean that digital is reserved exclusively for in-store transactions? Can’t it be used for something better, to enhance the relationship with the customer? Customers’ support for the vision of an augmented sales assistant offers hope. 49% of survey respondents welcome the use of technology by sales staff to provide better advice. Only 44% do not see this alliance between people and technology as a source of added value.

In conclusion

The survey results show that the era of digital for digital’s sake is over. Retailers are mistaken in seeing in-store digital devices as a source of enchantment. What counts is efficiency and added value. For the customer experience to be successful, retailers need to get “under the skin” of their customers and stop falling in love with technology. Innovation has a positive effect on customer appreciation. But it’s only transitory. The added value must be sustainable and respond to down-to-earth imperatives to enchant the customer-retailer relationship, saving time and money.

In 2023, we have entered an economy where two things are cruelly lacking: time and money. In-store digital devices must provide solutions to both problems.

Posted in Research.