B2B market research (one of our specialities) has some notable features when compared to B2C market research (see the full article we have devoted to B2C here). As the targets are not the same (B2B companies, B2C end consumers), adaptations (strategy, marketing, and so on) must be made to take these differences into account. In this section, we invite you to explore these differences with you, which will then lead us to propose market research methods adapted to the B2B context. We will also give you some tips on how to deal with the professionals who will hopefully be your customers tomorrow. If you have any questions, please do not hesitate to contact us. We will be happy to help you. We also remind you that you can consult our online market research guide here, which will guide you step by step through the analysis and success of your project.

Table of content

- Definitions

- Market Research Methods for use in B2B

- In what order to use the different methods

- Difficulties and attention points in B2B market research

Definitions

B2B (or “Business To Business”) refers to all the business processes that take place between one company and another. It follows that B2B sales are therefore made between a selling company (the supplier) and a buying company (the customer company). The customer company will be led to use, transform the products and services purchased to resell them to other companies (B2B2B) or to end consumers (B2B2C).

The B2B market is fundamentally different from the B2C market. It is governed by other rules, more complex decision-making processes, and generally involves suppliers from larger territories than in B2C. The competitive aspects will, therefore, be strongly affected.

Market research methods to be used in B2B

The purpose of this paragraph is to introduce you to the 3 essential methods for B2B market research. It is, therefore, not a question of being exhaustive (we refer you to our online guide for this purpose), but rather to consider the most effective and least costly methods to implement. This paragraph is therefore primarily addressed to start-ups and project leaders who need to verify the feasibility and relevance of their project from factual data and realistic market analysis. The 3 methods selected are the result of 15 years of practice in our firm and more than 100 projects carried out in B2B.

credits: Shutterstock

Market research method n°1: competition research

More than in any other context, the competition study is of crucial importance in B2B. In B2B, commercial strategies can indeed be better structured than in B2C, because larger companies prepare them, therefore with more resources than in B2C (which remains mainly in local trade the domain of small and medium-sized companies). In B2C the competition area is also much more significant, which will require you to look far beyond your immediate geographical territory.

We, therefore, advise you to study in depth your 3 main competitors. Make a synthetic grid to achieve your benchmark. Here are some ideas of the factors to be evaluated: financial factors (turnover, profits, margin, year-on-year evolution); geographical factors (territories served, specificity of your market and adaptation to it); customer satisfaction factors (is the customer satisfied by your competitors’ products/services? how do your competitors respond to customers’ “pain points”?); commercial factors (price levels, flexibility, speed of commercial response, size of the commercial force on the national market). To determine these factors, do not hesitate to brainstorm with someone who knows the market well (see Market Research Method 2: Expert Interviews). Indeed, even if you can find a lot of factual information online (mainly figures, but also opinions), the point of view of an expert can only be better translated in a discussion. It will also be an opportunity by establishing a relationship of trust to obtain information that might not have been made public.

The study of your competitors can be completed by an overall view using one of the many existing analysis schemes, for example, Porter’s 5 forces. We have devoted several articles on the subject, and you will also find below a course we have dedicated to this subject. The principle of Porter’s analysis lies in the evaluation of 5 forces that coexist in any non-monopolistic market, and that will define the difficulty for a new entrant to find a place in it. Michael Porter developed this model in 1979. Despite its age, it is still applicable and will give you a good overall indication of the ease/difficulty of finding a place on a market.

Tip: How to identify your main competitors?

To identify your main competitors, you need statistics on the national market where you will operate. Trade federations and other sectoral bodies are a valuable source of data. Do not hesitate to contact them (we have lists by country of these different organisations. If you wish to have access to them, do not hesitate to contact us while waiting for us to make them available on our website in the future).

credits: Shutterstock

Market research method n°2: qualitative interviews

As in B2C market research, it is necessary to go through a qualitative phase in B2B. However, the method must be adapted to the context. Indeed, professionals are not “targets” like the others and must, therefore, be approached appropriately. We, accordingly, advise you to proceed as follows:

Expert interviews

Experts are people who have extensive knowledge of the market in which you are interested. They may be specialised consultants, members of professional organisations or even diplomatic staff (each embassy has national economic experts who can be called upon, especially if you are a national of the country in question). The size of B2B markets and companies active in this sector justifies that people make it their speciality on a full-time basis. Their specialisation represents a significant added value for anyone wishing to carry out market research. It will notably be a question of identifying them upstream to understand which expert profiles are most likely to bring you added value.

Tip:

Get help from these experts to establish the criteria for evaluating competition and identify the “pain points” of B2B customers. Do not hesitate to ask for contacts to simplify your recruitment of people to be interviewed in the next phase.

Interviews with potential customers (customers of your competitors)

Face-to-face interviews are an essential part of market research (at least proper market research). Our online guide will help you to achieve them.

In a B2B context, it is essential to adapt the recruitment strategy. Indeed, the decision-making process in B2B is not the same as in B2C. Where a single consumer can decide B2C, in B2B, it is usually several people who are involved. Their functions within the client company force them to adopt different perspectives on a business proposal, so it is vital that you can understand what everyone is looking for to adapt your speech on the one hand, but your product or service on the other. The marketing strategy should, therefore, be personalised according to the interlocutor, and qualitative interviews will, therefore, aim to reveal the different facets to be highlighted according to your interlocutor. Be sure to interview a representative panel of the decision-making chain within the structures that will be your clients in the future.

Tip: Avoid focus groups

We sometimes receive customer requests for B2B market research with some of it conducted through focus groups. This method is to be avoided in B2B because it is complicated to implement, and the results can be debatable.

Why is it so difficult to organise a focus group in B2B: most professionals are busy people (think for example of managers or artisans). In your opinion, what efforts would you need to make to bring 6 to 8 of them together in a room for 2 to 3 hours in the evening?

Why are the results of a B2B focus group questionable? If by chance you manage to bring 6 to 8 professionals together in a room for a crazy group, it is very likely that these people will compete. What they say should, therefore, be taken with the greatest caution, as this may not adequately reflect reality.

Alternatively, you can try to bring together several players from the same company to receive their individual opinions. It will, of course, be a matter of selecting them on the spot, so that they can contribute to your research, or even have decision-making powers within the company.

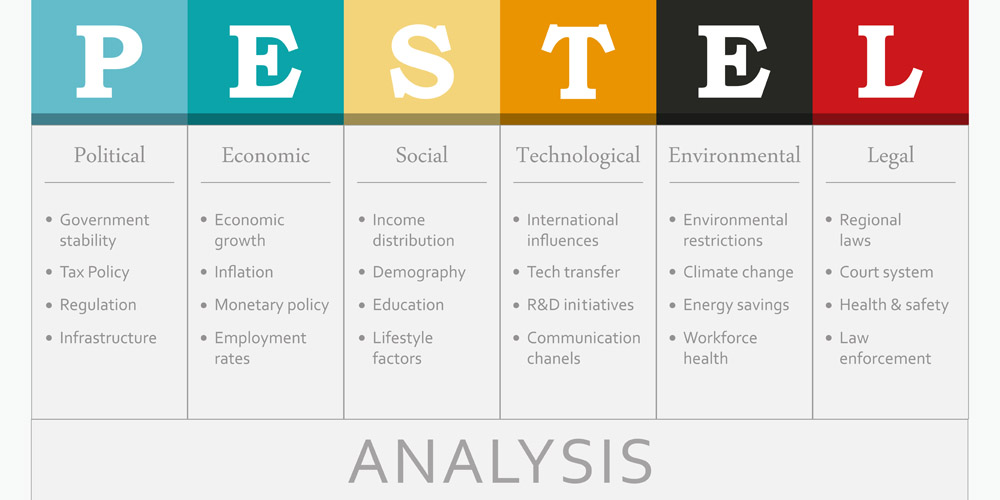

Market research method 3: environmental research

The 2 previous steps (competition study and qualitative interviews) will undoubtedly reveal new exogenous aspects that shape the market and determine its evolution. These aspects are called exogenous, because you, as a company, cannot influence them. These may include elements related to a country’s policy, the economic situation, tax policy, national or transnational legal aspects (European norms, standards, regulations or directives). Well anticipated, these exogenous factors can prove to be significant growth drivers. Your competitors may not have expected them, leaving you with the possibility of a better value proposition to which customers would be sensitive. This is what happened with the General Data Protection Regulations (GDPR), which allowed new companies to take market share, as companies had to adapt (often in a hurry) to this new piece of legislation. The difficulty is, of course, to perpetuate the resulting activity because very often the exploitation of such a business opportunity is more of a short-term strategy.

Tip:

To systematically study the exogenous factors that influence a market, use the PESTEL method that we have detailed in our online market research guide.

In which order should the different market research methods be used?

As we recommended in the article on B2C market research, you will need to make regular round trips between the 3 methods proposed above to enrich your knowledge and deepen your analysis. Markets are indeed dynamic, and the information provided at one stage can only be used to feed into the discussions that will be implemented at the next stage.

Example: You identify your 3 main competitors in step 1 and determine, from your knowledge, the evaluation criteria. It is very likely that the interviews you will conduct with the experts will allow you to identify other competitors and other important measures in the B2B purchasing decision. So why not start directly with interviews with experts, you might ask? This remark is entirely justified, and you could indeed begin to like that. However, it seems to us that it is better to “do your homework” before meeting with experts (whose time is limited) in order to give the impression that you have mastered the subject and to be more effective in structuring the conversation around the elements that you lack and those that you have identified as most crucial.

The same can be said for the link between interviews with potential customers and environmental research. The first will feed on the second and vice versa. You will therefore also have to go back and forth between the two, to enrich your interviews and test with your interlocutors the opportunities presented by exogenous factors. Also, depending on the interviews you conduct and your interlocutors, you may be led to exchange with potential customers, so this is a first contact to be pampered.

Difficulties and points of focus in B2B market research

Our experience as a market research firm shows us that B2B market research is generally more complicated to organise than B2C market research. This results from 2 aspects that are specific to B2B:

- The interlocutors are not very available, which complicates the analysis phases (in particular the qualitative phase).

- A single person does not decide within a company. The decision-making chain in B2B is complicated, so you should keep in mind that understanding and interrogating several functions of the same company may be necessary to understand the reality of the purchasing process. This is further complicated by the previous point (availability of respondents).

Tip:

In B2B, financial incentives to access respondents (compensation of €X for their time) are not very useful. We often meet professionals who refuse these financial compensation payments or who ask us to pay them to charities. To access the right people, you will, therefore, need to be recommended by someone. To do so, use your network, talk about your project and your research to those around you! If no one in your acquaintances is able or qualified to answer your questions, there is a strong probability that your contacts may know someone who can answer your questions.

Images: shutterstock

Posted in Marketing.