The inflationary environment requires retailers to adapt to defend their market share constantly. Part of their strategy is based on pricing. In this article, we analyze the strategy of Belgium’s 3 leading retailers: Carrefour, Delhaize, and Colruyt. This analysis is based on data from our partner PingPrice, whose application tracks supermarket product prices. Thanks to their data, we can uncover retailers’ pricing tactics to adapt to the very particular economic situation we are experiencing. In Colruyt’s case, we’re almost approaching the concept of dynamic pricing.

Discover IntoTheMinds’ market research services

Retailers’ pricing strategies in a nutshell

- Colruyt has changed the price of certain products more than once a week on average over the last 12 months.

- Neither Carrefour nor Delhaize follows such a rhythm in adapting their prices.

- Colruyt’s prices vary as much upwards as downwards. On the other hand, 7 out of 10 price changes at Delhaize are increases.

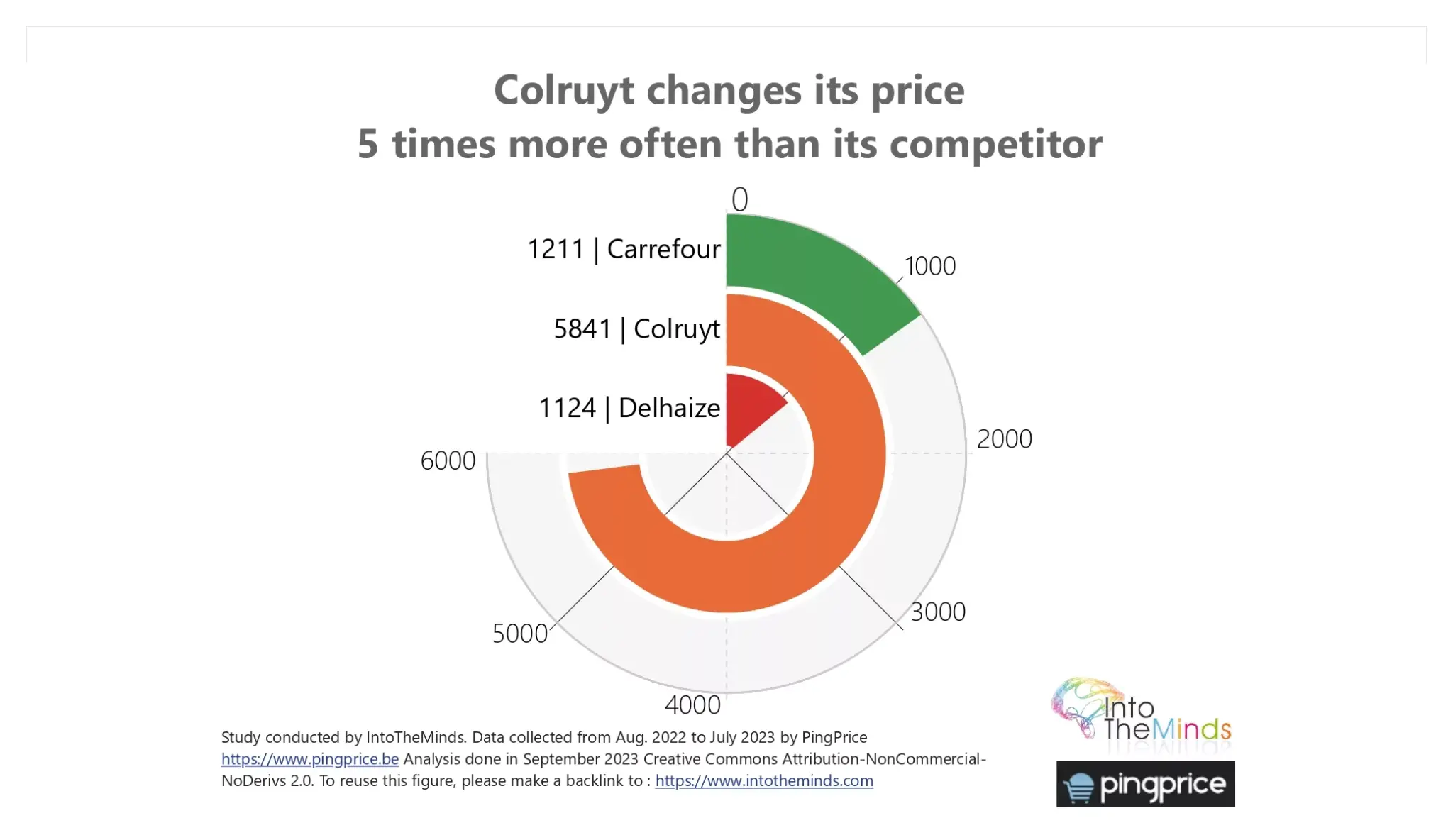

Colruyt: 100 products changed price 5841 times

The first important finding of this research concerns the frequency with which retailers adapt their prices. The graph below shows that Colruyt changes its prices far more often than its competitors. Thanks to PingPrice data, we were able to research the pricing practices of the 100 products that have undergone the most price changes. The results are clear: Colruyt has made 5 times more price changes than its competitors.

On certain perfume products, Colruyt changed its prices almost 80 times in 12 months, i.e., more than once a week.

Colruyt changed its prices almost 80 times in 12 months on certain perfumery products, i.e., more than once a week. In contrast, Delhaize does not appear to change its prices more than once a month. Between these two extremes lies Carrefour. The French distributor sometimes makes price changes every 15 days on certain products.

This difference in behavior raises questions. Why is the Colruyt supermarket chain so much more reactive than the others regarding price adjustments? The answer, no doubt, lies in its marketing strategy. It is based on guaranteeing consumers the “best prices.” This marketing message has been ingrained in the minds of Belgian consumers for decades, and Colruyt must defend it. This means reacting more quickly to competitors’ prices and promising to adapt its prices continuously. Colruyt also has a “red line” that allows consumers to report lower prices. Colruyt then promises to refund the difference and adapt its price immediately in-store.

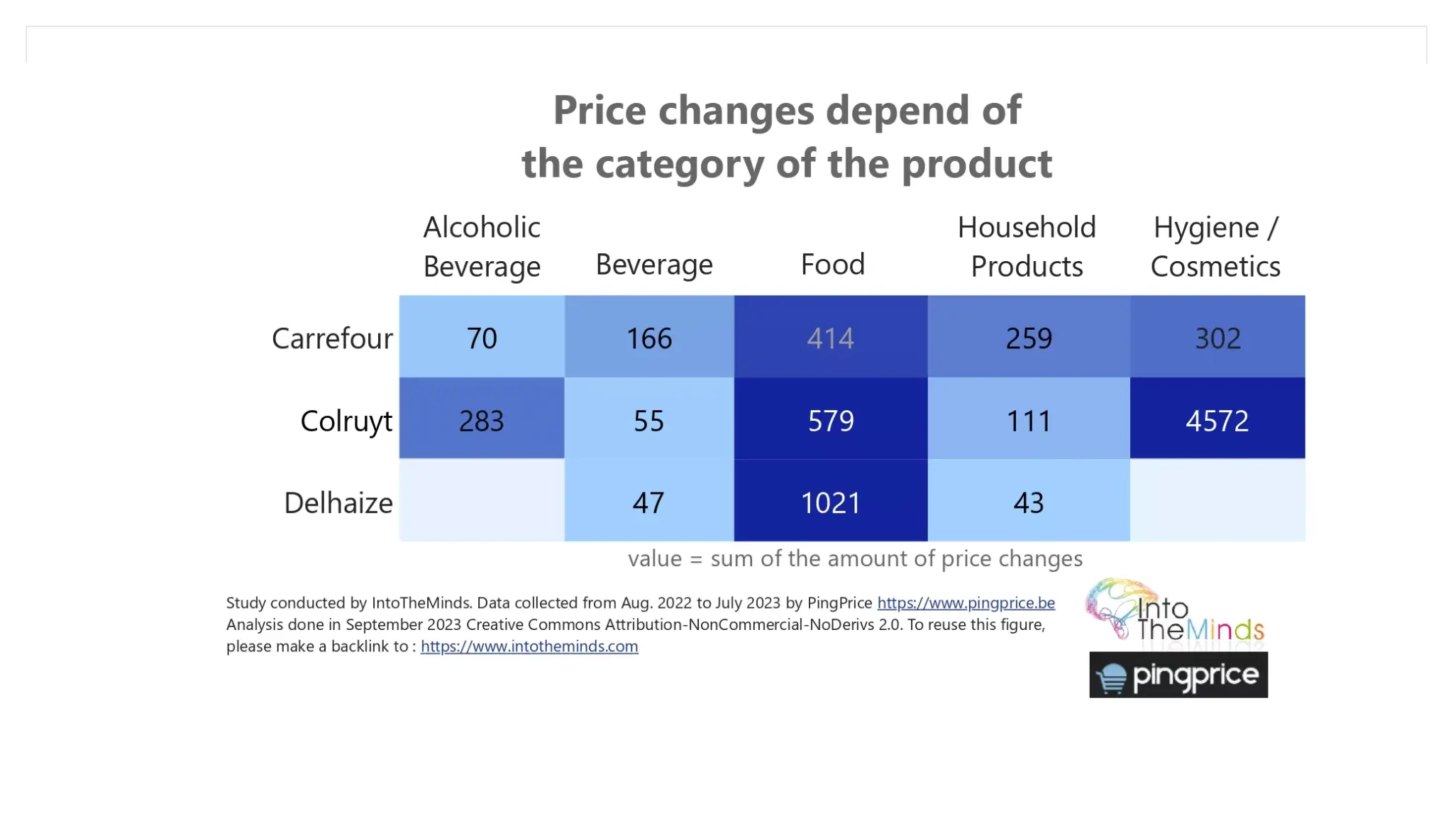

We also observe that retailers keep prices the same according to category. We have assigned each product we researched to a category, and we find very significant differences. Colruyt’s price variations mainly concern hygiene and cosmetics, while Delhaize focuses almost exclusively on food. At Carrefour, on the other hand, price changes are spread across all departments.

At Delhaize, price changes are mainly upwards

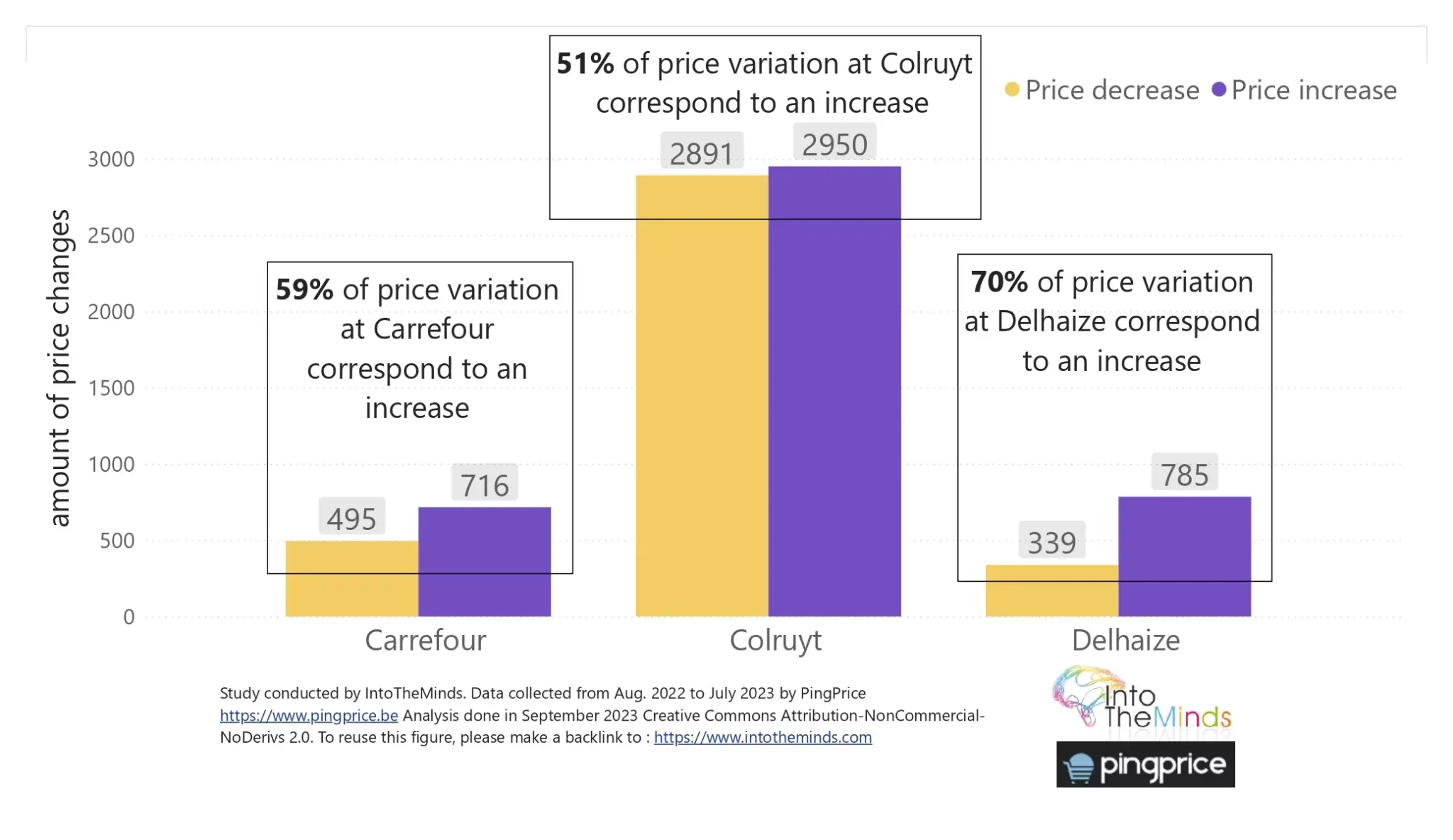

It’s interesting to look at the direction of these changes, having established the frequency. In other words, when a retailer changes its prices, does it tend to do so upwards or downwards? Here again, the results are surprising.

The data collected by PingPrice allows us to measure the gap between the new and old prices. Of all the changes observed in this research, Colruyt’s price changes more or less “balance out.” In other words, Colruyt made almost as many price cuts as price increases.

The situation is different from its competitors. Carrefour mainly adapts its prices upwards (59% of cases), while Delhaize raises prices even more often (70% of cases).

70% of Delhaize’s price changes are increases.

This does not, of course, indicate the extent of the increase, only its frequency.

Greater price variations at Delhaize

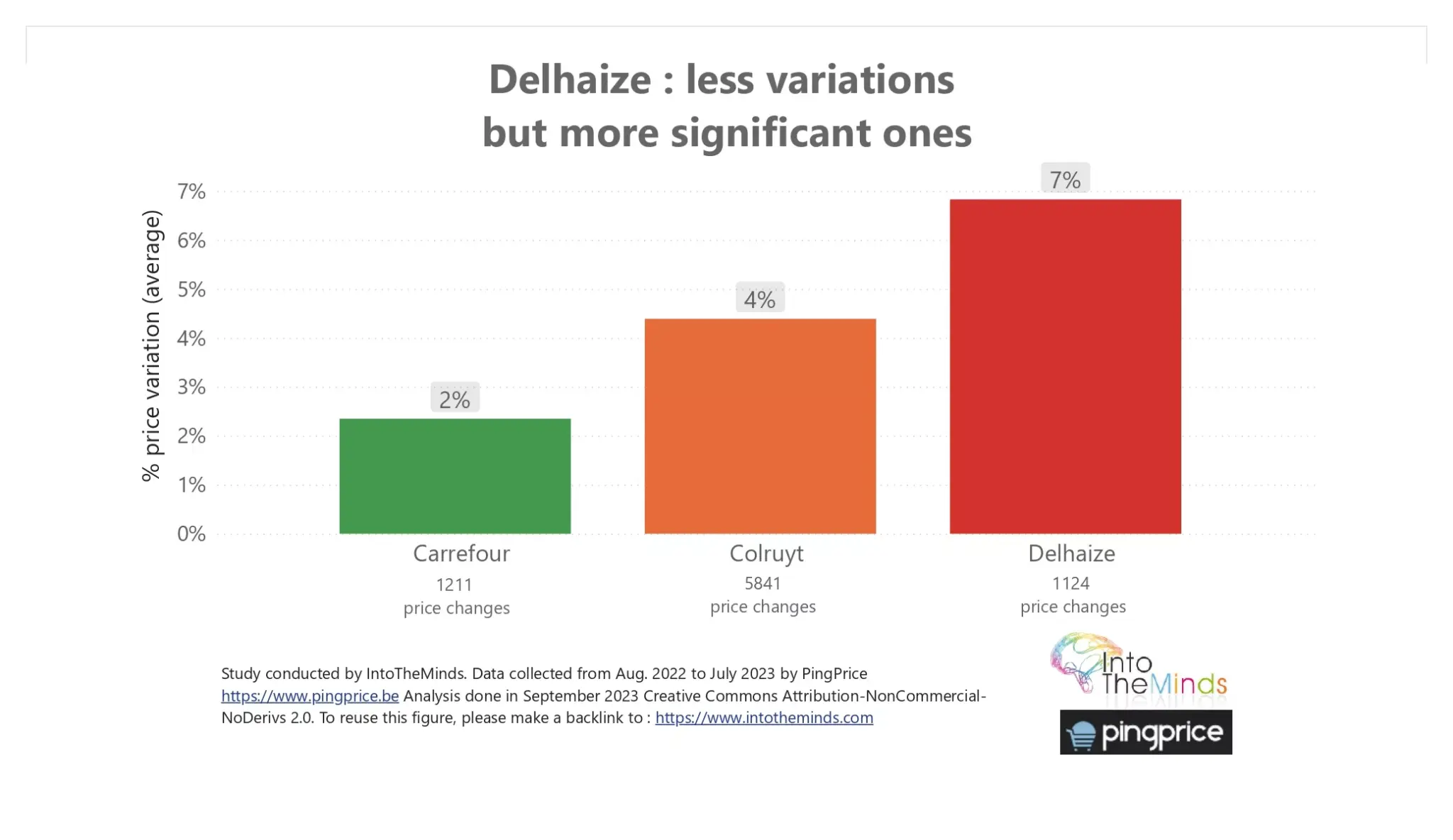

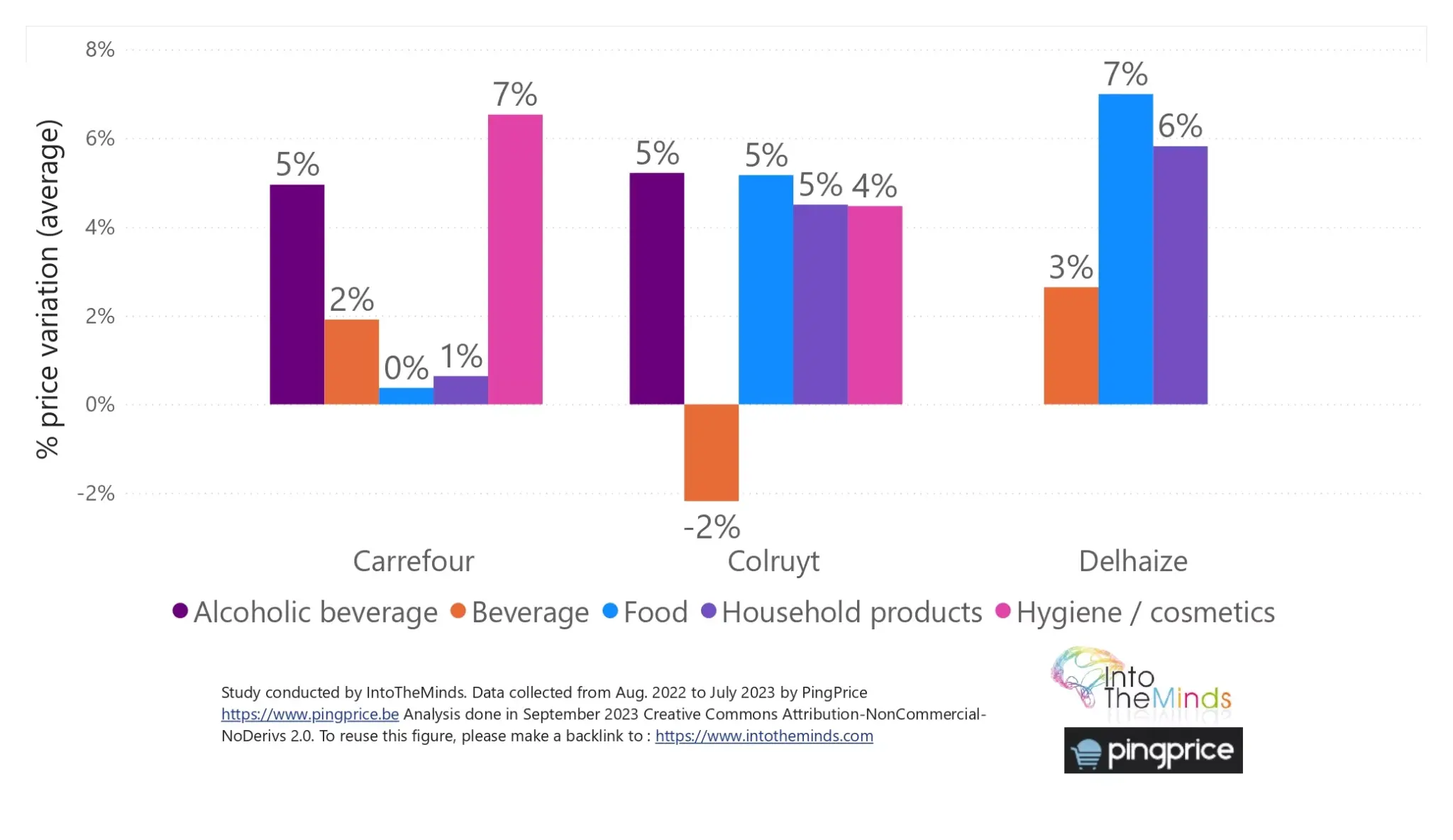

To complete the previous conclusion, we look at the amplitude of the price change in the next analysis. In other words, when a retailer changes the price of a product, what is the magnitude of this price change? This analysis gives us a better understanding of each retailer’s commercial strategy.

First, we can see that Delhaize’s price variations are greater than its competitors. The average variation for the 100 products researched was 7%. This means that, on average, when Delhaize changes the price of one of the 100 products we researched, the increase (or decrease) reaches 7%. This is in line with the frequency of changes observed. Delhaize makes fewer price changes than its competitors, but when a price changes, the increase (or decrease) is greater.

Carrefour’s situation is more complex to analyze. Of the 3 retailers researched, Carrefour is the one whose prices vary least in value. As we explained in the previous paragraph, PingPrice data shows that prices change on average every 15 days on certain products.

However, the variation is at most 2% on average. This could indicate more expensive prices requiring fewer price adjustments or a lesser need to defend margins.

In any case, what’s surprising is that Delhaize, already reputed to be Belgium’s most expensive retailer, varies the prices of the 100 products researched to such an extent.

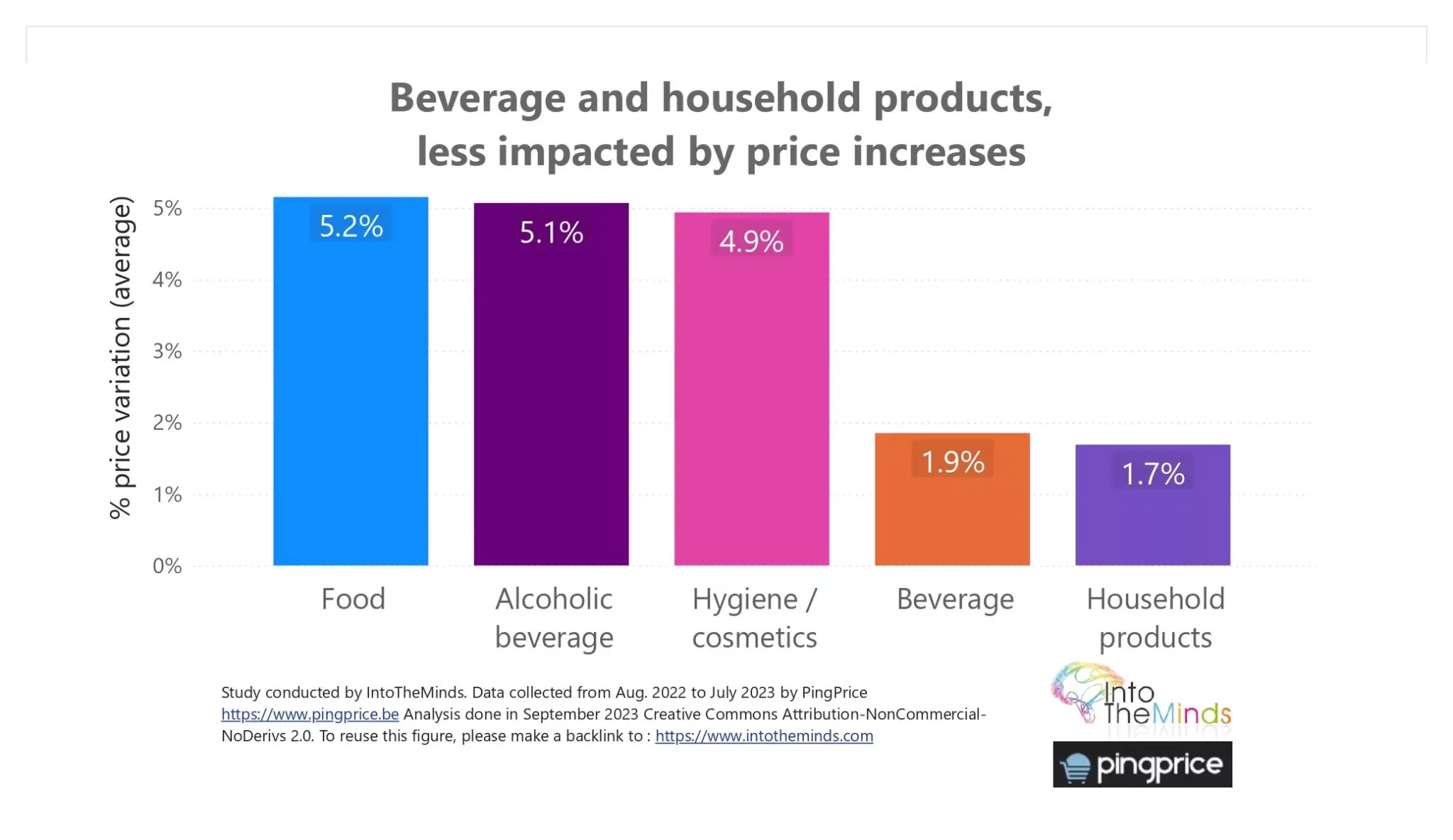

Price increases do not affect all departments equally

Finally, we analyzed price variations by product category. To simplify the analysis, we have associated the products researched with just 5 categories: food, alcoholic beverages, hygiene and cosmetics, non-alcoholic beverages, and household products.

Of the 100 products that have seen the biggest price changes over the last 12 months, we first notice that prices have risen on average. This should come as no surprise. However, these price rises are heterogeneous since they mainly concern 3 categories: food, spirits, and hygiene/cosmetics. The other 2 categories seem less affected.

Remember, however, that the analysis is limited to the 100 products that have most frequently changed price over the past 12 months.

Calculating the average percentage change per retailer to complete the above view would be interesting. Colruyt is the only retailer with a negative variation (price decrease) over the last 12 months in the beverage category. Of the 300 products (100 for each retailer), all other product categories show increases of up to 7% (hygiene/cosmetics department at Carrefour and food at Colruyt).

Posted in Research.